Diabetic Retinopathy Market (Treatment: Medication [Anti-VEGF Therapies, Corticosteroids], Devices [Laser Treatment Devices, Diagnostic Devices (Optical Coherence Tomography)], Vitrectomy, Laser Photocoagulation; Type: Non-Proliferative Diabetic Retinopathy (NPDR), Proliferative Diabetic Retinopathy (PDR); Diagnosis: Fluorescein Angiography, Optical Coherence Tomography (OCT), Fundus Photography, Visual Field Testing, Other Diagnostic Methods; Route of Administration: Oral Administration, Subcutaneous Administration, Ocular Administration (Eye Drops); End-user: Hospitals and Ophthalmology Clinics, Homecare Settings, Research Institutions) – Global Industry Analysis, Size, Share, Growth, Trends, and Forecast, 2024-2032.

Market Outlook

The global diabetic retinopathy market is set for substantial growth, driven by the rising industry size due to increasing diabetes prevalence and an expanding geriatric population. With a market value of approximately $3.89 billion in 2024, the market size is projected to reach $11.79 billion by 2032, growing at a CAGR of 13.7% (2025–2032). Key industry trends include advancements in anti-VEGF therapies and laser treatments, improving patient outcomes and boosting market share. Increasing awareness encourages early diagnosis, further driving industry growth. However, challenges such as ophthalmologist shortages and regulatory complexities may impact innovation. Growth opportunities lie in combined therapies for diabetic macular edema and telemedicine integration, enhancing patient care. With a strong market forecast, the industry is positioned for rapid expansion, driven by early detection initiatives and cutting-edge treatment strategies for diabetes-related eye complications. Companies leveraging technological advancements and scalable healthcare models will dominate the diabetic retinopathy market in the coming years.

Drivers

If this is not serious, we will not die: It is serious. Diabetes is considered serious in the neighborhood. One recent estimate suggests that 537 million adults were living with diabetes in 2021, which is projected to rise to 783 million by 2045 (International Diabetes Federation). Retinopathy is fairly common and presents a lucrative market for an efficacious therapy.

Increasing Elderly Population: The elderly population is growing rapidly, particularly in the developed world. The older an individual is, the greater the risk of developing diabetes and its complications, among others, DR. In the U.S., for instance, an estimated 4.1 million people aged forty and older have diabetic retinopathy. This emphasizes the need for therapies focused on this growing population

Advancements in Treatment Modalities: Innovations in treatment avenues, especially anti-VEGF therapies and combination therapy for diabetic macular edema, are improving patient outcome. For instance, the advent of drugs like aflibercept and ranibizumab has hugely changed vision-related quality of life for DR patients, thereby encouraging more to seek help.

| Specifications | Significance | Clinical Trials | Drugs/Interventions |

| Oral RG7774 (vicasinabin) | Non-invasive alternative to injections; targets moderate/severe non-proliferative DR. | CANBERRA (Phase II RCT, Roche): Assessing safety, tolerability, and efficacy. | RG7774 (oral medication) |

| Fenofibrate Repurposing | Existing lipid-lowering drug tested for DR prevention in type 1 diabetes. | Mater Research Trial (Phase III): Testing safety/efficacy in reducing DR risk. | Fenofibrate |

| Continuous Ranibizumab Delivery | Reduces injection frequency via port delivery system vs. monthly intravitreal. | JAMA Network Study (Phase III): Comparing port delivery with standard care. | Ranibizumab (anti-VEGF) |

| AI-Driven Screening | Faster, scalable screening to improve accessibility in underserved populations. | UCSD Trial (AI validation study): Testing AI accuracy in DR diagnosis. | AI algorithm (no drug) |

| HELIOS Phase I Therapy | Early efficacy in stabilizing/improving DR severity. | HELIOS (Phase I): Demonstrated safety and DRSS stability over 1 year. | Undisclosed drug (likely gene/cell therapy) |

| EyePoint Pharmaceuticals’ DME Treatment | Extended-release therapy reducing treatment burden for diabetic macular edema. | Phase 2 Trial: Positive results led to planned Phase 3 launch in late 2025. | Undisclosed drug (sustained-release formulation) |

Restraints

One of the important factors seen as hindering market growth while also impacting the overall industry size is the challenges faced by the ophthalmology industry. The absence of trained personnel for ophthalmic work in developing regions is one factor reasoned to be exerting constraints on timely diagnosis and treatment of diabetic retinopathy. Such a lack will also directly hinder market share growth since unmet medical needs retard the demand for surgical intervention. There is a huge gap in the number of eye care professionals as identified by the WHO, especially in low- and middle-income regions, causing a constraint to the industry value.

In addition, regulatory hindrances impede marketing approvals and thus slow down the acceptance of novel therapies. Inordinate delays in the approval of new therapies imply a long-duration clinical approach, thereby increasing development costs for the pharmaceutical organization and delaying commercial availability. These great regulatory impediments place uncertain values over the market forecast impairing investors’ confidence and incurring slow growth in the industry. Addressing these hurdles will require workforce development assessed, as well as continued simplification of regulatory pathways to maintain and promote expansion in market size and sustainable trends in the industry.

Opportunities

Telemedicine and Remote Monitoring: The growing telemedicine revolution in DR management will be able to add new market avenues. Remote monitoring systems can provide early identification and ongoing care through such facilities in underserved areas with little access to specialists. Investment in telehealth solutions could thus mean-highly economical investments by companies in this market growth trend.

Increased Awareness Campaigns: Increasing levels of awareness regarding routine eye examinations among diabetic patients are jointly adding fuel to the industry-size expansion. Public information campaigns on the dangers posed by diabetic retinopathy, as well as the need for early detection and ocular intervention, are seeking to increase the rates of screening and, as a result, heighten market demand for treatment modalities. The more patients are educated about what they need to do, the more diagnostics and therapeutic companies will benefit from the greater uptake in the markets. That even strengthens the industry’s bright forecast. Market last strong strategic investments on awareness campaigns and telemedicine line integration will put key players more firmly on the path for future market growth in this ophthalmic healthcare space.

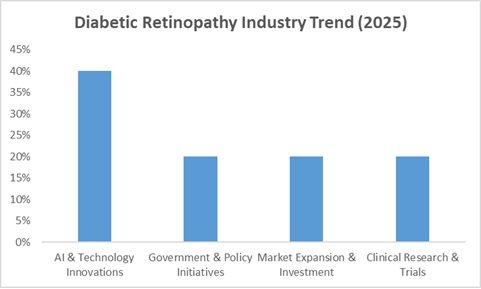

The market for Diabetic Retinopathy (DR) has undergone significant advancements, in which technology innovations such as AI lead strongly with 40%, spurred on by AI-supported diagnostic tools like Taiwan’s AI-DR and Malaysia’s DR. MATA. These applications enable DR screening with speed and accuracy, hence improving early detection rates. Government & policy initiatives (20%) include, for instance, the national screening programs such as India’s new DR screening guidelines for minimizing vision loss risks. Market advancements & investments (20%) report growing interest from global outfits such as Carl Zeiss, which flags India as a key growth market for AI-driven medical devices. Future treatments are being shaped by clinical research & trials (20%), such as Kodiak Sciences’ GLOW2 trial for tarcocimab tedromer that promise to transform DR management by reducing treatment frequency. With innovative AI, policy strategy, and prospective clinical trials, the DR market has placed itself for continued growth, bright patient outcomes, and wider access to advanced solutions in DR care.

The market for Diabetic Retinopathy (DR) has undergone significant advancements, in which technology innovations such as AI lead strongly with 40%, spurred on by AI-supported diagnostic tools like Taiwan’s AI-DR and Malaysia’s DR. MATA. These applications enable DR screening with speed and accuracy, hence improving early detection rates. Government & policy initiatives (20%) include, for instance, the national screening programs such as India’s new DR screening guidelines for minimizing vision loss risks. Market advancements & investments (20%) report growing interest from global outfits such as Carl Zeiss, which flags India as a key growth market for AI-driven medical devices. Future treatments are being shaped by clinical research & trials (20%), such as Kodiak Sciences’ GLOW2 trial for tarcocimab tedromer that promise to transform DR management by reducing treatment frequency. With innovative AI, policy strategy, and prospective clinical trials, the DR market has placed itself for continued growth, bright patient outcomes, and wider access to advanced solutions in DR care.

Competitive Landscape

VITAS Healthcare

Kindred Healthcare

HCR ManorCare

Amedisys, Inc.

Seasons Hospice & Palliative Care

Curo Health Services

Compassionate Care Hospice

Compassus

Hospice of the Valley

Elara Caring

Tidewell Hospice

Kaiser Permanente

Empath Health

Crossroads Hospice & Palliative Care

LHC Group

Market Segmentation

Segmentation by Treatment

- Medication

- Anti-VEGF Therapies

- Corticosteroids

- Devices

- Laser Treatment Devices

- Diagnostic Devices (e.g., Optical Coherence Tomography)

- Vitrectomy

- Laser Photocoagulation

Segmentation by Type

- Non-Proliferative Diabetic Retinopathy (NPDR)

- Proliferative Diabetic Retinopathy (PDR)

Segmentation by Diagnosis

- Fluorescein Angiography

- Optical Coherence Tomography (OCT)

- Fundus Photography

- Visual Field Testing

- Other Diagnostic Methods

Segmentation by Route of Administration

- Oral Administration

- Subcutaneous Administration

- Ocular Administration (eye drops)

Segmentation by End-Users

- Hospitals and Ophthalmology clinics

- Homecare Settings

- Research Institutions

FAQ

- What is the projected growth of the diabetic retinopathy market?

The market is expected to grow from $3.89 billion in 2024 to $11.79 billion by 2032, with a CAGR of 13.7% from 2025 to 2032.

- What factors are driving the diabetic retinopathy market growth?

Key drivers include the rising prevalence of diabetes, an aging population, and advancements in treatment modalities such as anti-VEGF therapies and laser treatments.

- What are the major challenges in the market?

Challenges include a shortage of skilled ophthalmologists and lengthy regulatory approval processes for new treatments.

- How is AI impacting the diabetic retinopathy market?

AI-driven diagnostic tools like Taiwan’s AI-DR and Malaysia’s DR.MATA enhance early detection, increasing screening rates and improving patient outcomes.

- What role does telemedicine play in diabetic retinopathy management?

Telemedicine enables remote monitoring and early detection, especially in underserved areas, improving patient access to specialized care.

- What are the key market segments for diabetic retinopathy treatment?

Treatments include medications (anti-VEGF, corticosteroids), devices (laser treatment, optical coherence tomography), vitrectomy, and laser photocoagulation.

- What are the different types of diabetic retinopathy?

The market is segmented into Non-Proliferative Diabetic Retinopathy (NPDR) and Proliferative Diabetic Retinopathy (PDR).

- What are the most common diagnostic methods?

Key methods include fluorescein angiography, optical coherence tomography (OCT), fundus photography, and visual field testing.

- Which companies are leading in the diabetic retinopathy market?

Major players include Carl Zeiss, Compassus, LHC Group, Kaiser Permanente, and Amedisys, Inc.

- What are the emerging trends in the diabetic retinopathy market?

Trends include AI-based diagnostics (40%), government screening programs (20%), market expansion and investment (20%), and clinical trials (20%) for innovative treatments.

Table Of Content

| 1. Executive Summary |

| 1.1. Definition |

| 1.2. Research Scope |

| 1.3. Key Findings by Major Segments |

| 2. Global Diabetic Retinopathy Market Overview |

| 2.1. Diabetic Retinopathy Market Dynamics |

| 2.1.1. Drivers |

| 2.1.2. Opportunities |

| 2.1.3. Restraints |

| 2.1.4. Challenges |

| 2.2. Product and Pricing Analysis |

| 2.3. Technological Advancements |

| 2.4. Key Industry Updates |

| 2.5. Regulatory Scenario by Region/ Countries |

| 2.6. Porters Five Forces Analysis |

| 3. Global Diabetic Retinopathy Market Outlook and Future Prospects, 2021-2032 |

| 3.1. Global Diabetic Retinopathy Market Analysis, 2021-2023 |

| 3.2. Global Diabetic Retinopathy Market Opportunity and Forecast, 2025-2032 |

| 3.3. Global Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Treatment, 2021-2032 |

| 3.3.1. Global Diabetic Retinopathy Market Analysis by Treatment: Introduction |

| 3.3.2. Market Trend, Analysis and Forecast, By Treatment, 2021-2032 |

| 3.3.2.1. Medication |

| 3.3.2.1.1. Anti-VEGF Therapies |

| 3.3.2.1.2. Corticosteroids |

| 3.3.2.2. Devices |

| 3.3.2.2.1. Laser Treatment Devices |

| 3.3.2.2.2. Diagnostic Devices |

| 3.3.2.3. Vitrectomy |

| 3.3.2.4. Laser Photocoagulation |

| 3.4. Global Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Type, 2021-2032 |

| 3.4.1. Global Diabetic Retinopathy Market Analysis By Type: Introduction |

| 3.4.2. Market Trend, Analysis and Forecast, By Type, 2021-2032 |

| 3.4.2.1. Non-Proliferative Diabetic Retinopathy (NPDR) |

| 3.4.2.2. Proliferative Diabetic Retinopathy (PDR) |

| 3.5. Global Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Diagnosis, 2021-2032 |

| 3.5.1. Global Diabetic Retinopathy Market Analysis By Diagnosis: Introduction |

| 3.5.2. Market Trend, Analysis and Forecast, By Diagnosis, 2021-2032 |

| 3.5.2.1. Fluorescein Angiography |

| 3.5.2.2. Optical Coherence Tomography (OCT) |

| 3.5.2.3. Fundus Photography |

| 3.5.2.4. Visual Field Testing |

| 3.5.2.5. Others |

| 3.6. Global Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Route of Administration, 2021-2032 |

| 3.6.1. Global Diabetic Retinopathy Market Analysis By Route of Administration: Introduction |

| 3.6.2. Market Trend, Analysis and Forecast, By Route of Administration, 2021-2032 |

| 3.6.2.1. Oral Administration |

| 3.6.2.2. Subcutaneous Administration |

| 3.6.2.3. Ocular Administration |

| 3.7. Global Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By End-users, 2021-2032 |

| 3.7.1. Global Diabetic Retinopathy Market Analysis by End-users: Introduction |

| 3.7.2. Market Trend, Analysis and Forecast, By End-users, 2021-2032 |

| 3.7.2.1. Hospitals and Opthalmology Clinics |

| 3.7.2.2. Homecare Settings |

| 3.7.2.3. Research Institutions |

| 3.8. Global Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Region, 2021-2032 |

| 3.8.1. Global Diabetic Retinopathy Market Analysis by Region : Introduction |

| 3.8.2. Market Trend, Analysis and Forecast, By Region , 2021-2032 |

| 3.8.2.1. North America |

| 3.8.2.2. Europe |

| 3.8.2.4. APAC |

| 3.8.2.5. Latin America |

| 3.8.2.6. Middle East & Africa |

| 4. North America Diabetic Retinopathy Market Outlook and Future Prospects, 2021-2032 |

| 4.1. North America Diabetic Retinopathy Market Analysis, 2021-2023 |

| 4.2. North America Diabetic Retinopathy Market Opportunity and Forecast, 2025-2032 |

| 4.3. North America Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Treatment, 2021-2032 |

| 4.3.1. Medication |

| 4.3.1.1. Anti-VEGF Therapies |

| 4.3.1.2. Medication |

| 4.3.2. Devices |

| 4.3.2.1. Laser Treatment Devices |

| 4.3.2.2. Diagnostic Devices |

| 4.3.3. Vitrectomy |

| 4.3.4. Laser Photocoagulation |

| 4.4. North America Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Type, 2021-2032 |

| 4.4.1. Non-Proliferative Diabetic Retinopathy (NPDR) |

| 4.4.2. Proliferative Diabetic Retinopathy (PDR) |

| 4.5. North America Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Diagnosis, 2021-2032 |

| 4.5.1. Fluorescein Angiography |

| 4.5.2. Optical Coherence Tomography (OCT) |

| 4.5.3. Fundus Photography |

| 4.5.4. Visual Field Testing |

| 4.5.5. Others |

| 4.6. North America Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Route of Administration, 2021-2032 |

| 4.6.1. Oral Administration |

| 4.6.2. Subcutaneous Administrations |

| 4.6.3. Ocular Administration |

| 4.7. North America Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By End-users, 2021-2032 |

| 4.7.1. Hospitals and Opthalmology Clinics |

| 4.7.2. Homecare Settings |

| 4.7.3. Research Institutions |

| 4.8. North America Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 4.8.1. U.S. |

| 4.8.2. Canada |

| 5. Europe Diabetic Retinopathy Market Outlook and Future Prospects, 2021-2032 |

| 5.1. Europe Diabetic Retinopathy Market Analysis, 2021-2023 |

| 5.2. Europe Diabetic Retinopathy Market Opportunity and Forecast, 2025-2032 |

| 5.3. Europe Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Treatment, 2021-2032 |

| 5.3.1. Medication |

| 5.3.1.1. Anti-VEGF Therapies |

| 5.3.1.2. Medication |

| 5.3.2. Devices |

| 5.3.2.1. Laser Treatment Devices |

| 5.3.2.2. Diagnostic Devices |

| 5.3.3. Vitrectomy |

| 5.3.4. Laser Photocoagulation |

| 5.4. Europe Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Type, 2021-2032 |

| 5.4.1. Non-Proliferative Diabetic Retinopathy (NPDR) |

| 5.4.2. Proliferative Diabetic Retinopathy (PDR) |

| 5.5. Europe Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Diagnosis, 2021-2032 |

| 5.5.1. Fluorescein Angiography |

| 5.5.2. Optical Coherence Tomography (OCT) |

| 5.5.3. Fundus Photography |

| 5.5.4. Visual Field Testing |

| 5.5.5. Others |

| 5.6. Europe Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Route of Administration, 2021-2032 |

| 5.6.1. Oral Administration |

| 5.6.2. Subcutaneous Administrations |

| 5.6.3. Ocular Administration |

| 5.7. Europe Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By End-users, 2021-2032 |

| 5.7.1. Hospitals and Opthalmology Clinics |

| 5.7.2. Homecare Settings |

| 5.7.3. Research Institutions |

| 5.8. Europe Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 5.8.1. Germany |

| 5.8.2. UK |

| 5.8.3. France |

| 5.8.4. Spain |

| 5.8.5. Italy |

| 5.8.6. Denmark |

| 5.8.7. Rest of Europe |

| 6. Asia Pacific Diabetic Retinopathy Market Outlook and Future Prospects, 2021-2032 |

| 6.1. Asia Pacific Diabetic Retinopathy Market Analysis, 2021-2023 |

| 6.2. Asia Pacific Diabetic Retinopathy Market Opportunity and Forecast, 2026-2032 |

| 6.3. Asia Pacific Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Treatment, 2021-2032 |

| 6.3.1. Medication |

| 6.3.1.1. Anti-VEGF Therapies |

| 6.3.1.2. Medication |

| 6.3.2. Devices |

| 6.3.2.1. Laser Treatment Devices |

| 6.3.2.2. Diagnostic Devices |

| 6.3.3. Vitrectomy |

| 6.3.4. Laser Photocoagulation |

| 6.4. Asia Pacific Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Type, 2021-2032 |

| 6.4.1. Non-Proliferative Diabetic Retinopathy (NPDR) |

| 6.4.2. Proliferative Diabetic Retinopathy (PDR) |

| 6.5. Asia Pacific Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Diagnosis, 2021-2032 |

| 6.5.1. Fluorescein Angiography |

| 6.5.2. Optical Coherence Tomography (OCT) |

| 6.5.3. Fundus Photography |

| 6.5.4. Visual Field Testing |

| 6.5.5. Others |

| 6.6. Asia Pacific Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Route of Administration, 2021-2032 |

| 6.6.1. Oral Administration |

| 6.6.2. Subcutaneous Administrations |

| 6.6.3. Ocular Administration |

| 6.7. Asia Pacific Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By End-users, 2021-2032 |

| 6.7.1. Hospitals and Opthalmology Clinics |

| 6.7.2. Homecare Settings |

| 6.7.3. Research Institutions |

| 6.8. Asia Pacific Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 6.8.1. China |

| 6.8.2. Japan |

| 6.8.3. India |

| 6.8.4. Australia & New Zealand |

| 6.8.5. South Korea |

| 6.8.6. Singapore |

| 6.8.7. Rest of Asia Pacific |

| 7. Latin America Diabetic Retinopathy Market Outlook and Future Prospects, 2021-2032 |

| 7.1. Latin America Diabetic Retinopathy Market Analysis, 2021-2023 |

| 7.2. Latin America Diabetic Retinopathy Market Opportunity and Forecast, 2027-2032 |

| 7.3. Latin America Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Treatment, 2021-2032 |

| 7.3.1. Medication |

| 7.3.1.1. Anti-VEGF Therapies |

| 7.3.1.2. Medication |

| 7.3.2. Devices |

| 7.3.2.1. Laser Treatment Devices |

| 7.3.2.2. Diagnostic Devices |

| 7.3.3. Vitrectomy |

| 7.3.4. Laser Photocoagulation |

| 7.4. Latin America Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Type, 2021-2032 |

| 7.4.1. Non-Proliferative Diabetic Retinopathy (NPDR) |

| 7.4.2. Proliferative Diabetic Retinopathy (PDR) |

| 7.5. Latin America Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Diagnosis, 2021-2032 |

| 7.5.1. Fluorescein Angiography |

| 7.5.2. Optical Coherence Tomography (OCT) |

| 7.5.3. Fundus Photography |

| 7.5.4. Visual Field Testing |

| 7.5.5. Others |

| 7.6. Latin America Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Route of Administration, 2021-2032 |

| 7.6.1. Oral Administration |

| 7.6.2. Subcutaneous Administrations |

| 7.6.3. Ocular Administration |

| 7.7. Latin America Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By End-users, 2021-2032 |

| 7.7.1. Hospitals and Opthalmology Clinics |

| 7.7.2. Homecare Settings |

| 7.7.3. Research Institutions |

| 7.8. Latin America Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 7.8.1. Brazil |

| 7.8.2. Mexico |

| 7.8.3. Colombia |

| 7.8.4. Rest of Latin America |

| 8. Middle East & Africa Diabetic Retinopathy Market Outlook and Future Prospects, 2021-2032 |

| 8.1. Middle East & Africa Diabetic Retinopathy Market Analysis, 2021-2023 |

| 8.2. Middle East & Africa Diabetic Retinopathy Market Opportunity and Forecast, 2028-2032 |

| 8.3. Middle East & Africa Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Treatment, 2021-2032 |

| 8.3.1. Medication |

| 8.3.1.1. Anti-VEGF Therapies |

| 8.3.1.2. Medication |

| 8.3.2. Devices |

| 8.3.2.1. Laser Treatment Devices |

| 8.3.2.2. Diagnostic Devices |

| 8.3.3. Vitrectomy |

| 8.3.4. Laser Photocoagulation |

| 8.4. Middle East & Africa Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Type, 2021-2032 |

| 8.4.1. Non-Proliferative Diabetic Retinopathy (NPDR) |

| 8.4.2. Proliferative Diabetic Retinopathy (PDR) |

| 8.5. Middle East & Africa Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Diagnosis, 2021-2032 |

| 8.5.1. Fluorescein Angiography |

| 8.5.2. Optical Coherence Tomography (OCT) |

| 8.5.3. Fundus Photography |

| 8.5.4. Visual Field Testing |

| 8.5.5. Others |

| 8.6. Middle East & Africa Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Route of Administration, 2021-2032 |

| 8.6.1. Oral Administration |

| 8.6.2. Subcutaneous Administrations |

| 8.6.3. Ocular Administration |

| 8.7. Middle East & Africa Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By End-users, 2021-2032 |

| 8.7.1. Hospitals and Opthalmology Clinics |

| 8.7.2. Homecare Settings |

| 8.7.3. Research Institutions |

| 8.8. Middle East & Africa Diabetic Retinopathy Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 8.8.1. GCC Countries |

| 8.8.2. South Africa |

| 8.8.3. Rest of Middle East & Africa |

| 9. Global Diabetic Retinopathy Market Competitive Landscape, Market Share Analysis, and Company Profiles |

| 9.1. Diabetic Retinopathy Market Share Analysis, By Company (2024) |

| 9.2. Company Profiles |

| 1. VITAS Healthcare |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 2. Kindred Healthcare |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 3. HCR ManorCare |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 4. Amedisys, Inc. |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 5. Seasons Hospice & Palliative Care |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 6. Curo Health Services |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 7. Compassionate Care Hospice |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 8. Compassus |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 9. Hospice of the Valley |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 10. Elara Caring |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 11. Tidewell Hospice |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 12. Kaiser Permanente |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 13. Empath Health |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 14. Crossroads Hospice & Palliative Care |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 15. LHC Group |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 9.3. Competitive Comparison Matrix |

| 10. Research Methodology |

| 11. Conclusion and Recommedations |