Weight Management Market: Type (Equipment [Fitness Equipment, Surgical Equipment], Services [Consulting Services, Fitness Centers, Online Weight Loss Programs, Supplements]); Diet (Meals [Meal Replacements, Low-Calorie Foods, Organic Foods], Beverages [Diet Soft Drinks, Herbal Teas, Slimming Waters, Nutraceuticals]); Application (Weight Maintenance, Body Shaping, Sports Injuries, Aesthetic Procedures, Chronic Wound Management); Age Group (Children, Adults, Senior Citizens); Distribution Channel (Multi-Level Marketing (MLM), Retail Channels [Large Retailers, Small Retailers, Health and Beauty Stores], Online Channels)

Market Outlook

The weight management market is experiencing strong growth, driven by increasing health awareness, rising obesity rates, and advancements in fitness technology. Valued at approximately $153.2 Billion in 2024, the market is projected to reach $394.3 Billion by 2032, with a compound annual growth rate (CAGR) of 6.1% during the forecast period from 2025 to 2032. It is poised to register a gross amount of expansion during the projection period, successively fuelling major market shares held by fitness equipment on the account of home workout preference and gym memberships. Increasing demand for equipment has been evident for minimally invasive bariatric operations and acute cases of obesity.

Current trends include the emergence of such online weight loss programs and consulting services that find it most impact as they give room for more convenience care and expert-driven solutions. The diet sector, which will comprise meal replacements, low-calorie foods, and nutraceutical beverages, is expected to hold steady as health-conscious consumers buy more of its products.

Segmented by application into weight maintenance, body shaping, sports injury recovery, and aesthetic procedures, the market is being given increased attention by solutions for different age groups. The growth of the online and retail distribution channels gives more attention to the market increase, which would continue in the coming years.

Market Drivers for the Weight Loss and Weight Management Industry

- Rising Obesity Rates and Related Health Conditions

Obesity is now a global health challenge affecting millions of people in different age groups. The very rise in obesity has given rise to the corresponding maladies such as diabetes, hypertension, and heart disease. The consciousness is now being raised more among the general public to affect weight management for health and longevity besides societal accepted aesthetic norms. A demand is rising for effective and sustainable weight loss solutions. Long-term solutions and prevention against diseases related to obesity are being sought, including personalized diet plans, fitness programs, and medically supervised weight management programs.

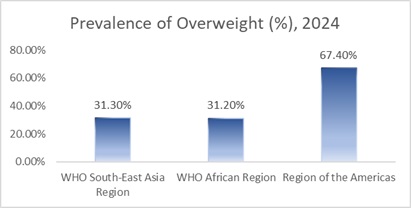

Regional Overweight Prevalence (2024)

- Technological Advancements Enhancing Accessibility

The latest technological innovations are revolutionizing how people manage their weight. Weight loss has now been made easier and fun by mobile applications that keep track of food intakes, physical activity, and progress overall. Wearable devices like smartwatches and fitness trackers, on the other hand, offer the real-time feedback on activity levels and heart rates to encourage consistency and motivation. Telehealth services have also come in handy for people needing a physician’s help but lack the time or access to consultations in person. Generally, such tools empower individuals through data-driven insights and personal recommendations to make weight management easier than ever before.

- Growing Awareness of Health Risks

Health hazards associated with obesity, such as metabolic syndrome and Type 2 diabetes and certain types of cancers, are now gaining more awareness; therefore, people are setting health-oriented lifestyles as their top priority. Awareness campaigns run by public health and educational programs are doing their part to inform the public of all long-term risks of poorly managed weight.

This shift is driving demand for healthier eating habits, regular exercise, and medically supported weight loss treatments. As individuals seek to reduce their health risks, the need for professional wellness programs, nutritional counseling, and holistic weight management solutions is also growing.

- Awareness Campaigns: Various campaigns worldwide are actively encouraging weight management and healthy lifestyles.

| Campaign Name | Organizer | Focus Area | Key Highlights |

| Better Health Adult Obesity Campaign (2023) | Better Health (UK) | Encourages adults to lose weight, eat healthily, and stay active | Offers free tools like the NHS Weight Loss Plan app |

| World Obesity Day 2023 | World Obesity Federation | “Changing Perspectives: Let’s Talk About Obesity” theme | Corrects obesity misconceptions & encourages action |

| Your Weight Matters Campaign | Obesity Action Coalition (OAC) | Encourages people to seek medical advice for weight management | Empowers individuals through education and healthcare guidance |

| LiveLighter Campaign | Western Australia Health | Raises awareness about the dangers of visceral fat and sugary drinks | Uses graphic images to show the health risks of obesity |

- Public Health Initiatives: Governments and global health organizations are launching programs to combat obesity.

| Initiative | Organizer | Objective |

| WHO Initiatives | World Health Organization (WHO) | Supports World Obesity Day to promote healthy weight strategies |

| Saudi Arabia’s Health Awareness | Saudi Ministry of Health | Raises awareness, invites experts and businesses to drive change |

- Education Programs: Educational initiatives help people adopt healthier lifestyles through structured guidance.

| Program | Organizer | Objective |

| NHS Active 10 and Couch to 5K Apps | Better Health (UK) | Encourages structured physical activity |

| Obesity Care Week | Obesity Action Coalition (OAC) | Improves understanding and care for obesity-related issues |

Restraints in Growth in the Weight Loss Market

Skepticism Towards Weight Loss Products

Naturally, many consumers remain skeptical of weight loss products. Given the number of fad diets, hyperbole over claims, and untested supplements promising fast results but failing to deliver, they have all had their fair share of disappointment; hence, the learned skepticism. Millions now seem to exercise great caution as they wonder whether the effective magic treatments, new programs, or consumables would amount to anything or just be another gimmick. Yet this would keep them away from the much safer and scientifically backed alternatives. Trust once rebuilt requires intensive transparency, evidence-based claims, and then well-communicated approaches from manufacturers and healthcare. This is because skepticism will continue to be a major obstacle to adoption of new weight loss products, even by those honestly pursuing effective help.

Opportunities for Growth in the Weight Loss Market

- Growth of Online Weight Loss Programs

The digital weight loss market has found its boom mainly because of consumers’ preference for flexible and convenient methods. This expansion is driven by advances in technology and meanwhile, the personalization of health care by AI. For example, WeightWatchers now includes AI-enhanced tools to drive engagement and effectiveness. There has been rising demand for effective weight management solutions due to the growing incidence of obesity and related health risks. Companies specializing in user-centric digital platforms offering live coaching, tailored meal programs, and interactive community support stand to gain significant shares in this emerging industry.

- Personalized Nutrition Solutions

Lately, the personalized nutrition field has found itself gaining significant traction due to consumer awareness of individualized dietary concerns. Accordingly, advances in technology allow for cooking-your-nutrition plans depending upon one’s genetic profile, lifestyle habits, and health goals. A recent example would, of course, be Instacart’s beautiful initiation of the AI-oriented “Smart Shop” function, which allows users to further personalize grocery shopping experiences according to 14 dietary preferences.

Additionally, WeightWatchers has enlisted some new technologies into their program such as macronutrient tracking and AI-based programs that help facilitate individual weight-management strategies. In this sense, a consumer-centered approach boosts satisfaction and thereby engenders loyalty and trust in the long term, which would allow respective firms to really go after a bigger share in the growing personalized nutrition marketplace.

Recent Advancements

- In December 2024, Eli Lilly and Company announced the results of a randomized clinical trial comparing Zepbound (tirzepatide) to Wegovy (semaglutide) in adults with obesity without diabetes. The trial showed that Zepbound provided a 47% greater relative weight loss compared to Wegovy, with an average weight loss of 20.2%. At 72 weeks, Zepbound beat Wegovy on all primary endpoints and all five key secondary endpoints. The overall safety profile of Zepbound in SURMOUNT-5 was similar to previous trials, with most commonly reported adverse events being gastrointestinal-related.

- The global obesity prevalence has shown a concerning trend, with 1 in 8 people living with obesityin 2022. Since 1990, adult obesity has more than doubled, while adolescent obesity has quadrupled. This period has seen a significant increase in the number of obese adults, reaching 890 million or 16% of the adult population. The market size of the obesity issue is substantial, with 5 billion adults (43%) being overweight.

The forecast for obesity management services and products looks promising due to the growing demand for weight management solutions. The market share of obesity-related products and services is expected to expand as governments and health organizations implement policies to curb obesity.

Over the past few decades, the trend of obesity growth has been consistent, with a notable increase in overweight children, particularly in Asia and Africa. The period from 1990 to 2022 has seen a rise in adolescent overweight rates from 8% to 20%. As obesity becomes a major public health challenge, the market for obesity management is likely to experience significant growth in the coming year.

| Age Group | Overweight Definition | Obesity Definition |

| Adults (18+ years) | BMI ≥ 25 | BMI ≥ 30 |

| Children (<5 years) | Weight-for-height > 2 SD above WHO median | Weight-for-height > 3 SD above WHO median |

| Children (5–19 years) | BMI-for-age > 1 SD above WHO Growth Reference median | BMI-for-age > 2 SD above WHO Growth Reference median |

Regional Insights

North America

- United States: The prevalence of obesity among older adults (60 and older) was reported at approximately 39% during 2021-2023, with 28% for men and 34% for women in some studies.

Europe

- General Prevalence: Obesity prevalence among older adults in Europe was estimated at 33.6%

- United Kingdom: Noted for having high obesity rates, influenced by factors like socioeconomic status and lifestyle changes.

- Spain: Studies highlight gender differences in obesity among the elderly, linked to physical activity and lifestyle.

Latin America

- South America: The highest prevalence of obesity among older adults was reported here, at 40.4%.

- Brazil: Obesity prevalence among the elderly was found to be 33%.

- Mexico: A study reported a high prevalence of obesity in older women, at 76%.

Asia Pacific

- Asia: The prevalence of obesity among older adults was estimated at 15%

- China: Obesity prevalence among the elderly was reported at 11% in a study covering 25 provinces.

- Australia: A high prevalence of obesity in the elderly was noted, at 43%.

- India: Obesity prevalence among older adults was reported at 32%.

- South Korea: A lower prevalence of obesity was observed, at 4%.

Middle East and Africa

- Africa: Obesity prevalence among older adults was estimated at 32%

- Iran: Obesity prevalence among the elderly was reported at 30%.

- Middle East and North Africa: These regions have high combined rates of underweight and obesity, reflecting a double burden of malnutrition

Competitive Landscape

Herbalife

Jenny Craig, Inc.

Nutrisystem

Medifast

WW International (formerly Weight Watchers)

Noom

Beachbody

Isagenix

Plexus Worldwide

AdvoCare

Diet-to-Go

South Beach Diet

LifeMD

Retrofit

Apollo Endosurgery Inc.

Market Segmentation

- Segmentation by Type

- Equipment:

- Fitness Equipment

- Surgical Equipment

- Services:

- Consulting Services

- Fitness Centers

- Online Weight Loss Programs

- Supplement

- Segmentation by Diet

- Meals:

- Meal Replacements

- Low-Calorie Foods

- Organic Foods

- Beverages:

- Diet Soft Drinks

- Herbal Teas

- Slimming Waters

- Nutraceuticals

- Segmentation by Application

- Weight Maintenance

- Body Shaping

- Sports Injuries

- Aesthetic Procedures

- Chronic Wound Management

- Segmentation by Age

- Children

- Adults

- Senior Citizens

- Segmentation by Distribution Channel

- Retail Channels

- Health and Beauty Stores

- Online Channels

FAQ

What is the forecast for the weight loss market?

The weight loss market is expected to grow significantly due to rising obesity rates, increased health awareness, and advancements in digital health solutions.

What trends are shaping the weight management industry?

Key trends include the adoption of digital weight loss solutions, personalized nutrition, and telehealth services, along with growing consumer demand for evidence-based treatments.

How has obesity prevalence changed over the period from 1990 to 2022?

Over this period, adult obesity has more than doubled, and adolescent obesity has quadrupled, contributing to a growing demand for weight management solutions.

What is the current market size for obesity-related products and services?

The obesity-related market is substantial, with approximately 2.5 billion adults (43%) classified as overweight, driving demand for weight management solutions.

What factors are driving market growth in weight loss solutions?

Market growth is fueled by increased awareness of obesity-related health risks, government health initiatives, and technological innovations in digital health and telemedicine.

What is the market share of online weight loss programs?

Online weight loss programs are gaining market share due to their convenience, flexibility, and increasing consumer preference for remote wellness solutions.

How do consumer attitudes toward weight loss products impact market trends?

Skepticism toward fad diets and unproven supplements has led to a demand for transparent, evidence-based weight loss solutions backed by scientific research.

How does regional obesity prevalence impact market opportunities?

Regions with high obesity rates, such as North America and Latin America, present significant opportunities for weight management products and services.

What impact has technology had on weight management trends?

Innovations such as mobile apps, wearables, and AI-driven nutrition plans have transformed weight management, making it more personalized and accessible.

How is the pharmaceutical market responding to obesity trends?

Companies like Eli Lilly and Novo Nordisk are developing advanced weight loss drugs, with recent trials showing promising results for treatments like Zepbound and Wegovy.

Table Of Content

| 1. Executive Summary |

| 1.1. Definition |

| 1.2. Research Scope |

| 1.3. Key Findings by Major Segments |

| 2. Global Weight Loss and Weight Management Market Overview |

| 2.1. Weight Loss and Weight Management Market Dynamics |

| 2.1.1. Drivers |

| 2.1.2. Opportunities |

| 2.1.3. Restraints |

| 2.1.4. Challenges |

| 2.2. Product and Pricing Analysis |

| 2.3. Technological Advancements |

| 2.4. Key Industry Updates |

| 2.5. Regulatory Scenario by Region/ Countries |

| 2.6. Porters Five Forces Analysis |

| 3. Global Weight Loss and Weight Management Market Outlook and Future Prospects, 2021-2032 |

| 3.1. Global Weight Loss and Weight Management Market Analysis, 2021-2023 |

| 3.2. Global Weight Loss and Weight Management Market Opportunity and Forecast, 2025-2032 |

| 3.3. Global Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Type, 2021-2032 |

| 3.3.1. Global Weight Loss and Weight Management Market Analysis by Type: Introduction |

| 3.3.2. Market Trend, Analysis and Forecast, By Type, 2021-2032 |

| 3.3.2.1. Equipment |

| 3.3.2.1.1. Fitness Equipment |

| 3.3.2.1.2. Surgical Equipment |

| 3.3.2.2. Services |

| 3.3.2.2. Consulting Services |

| 3.3.2.2. Fitness Centers |

| 3.3.2.2. Online Weight Loss Programs |

| 3.3.2.2. Supplement |

| 3.4. Global Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Diet, 2021-2032 |

| 3.4.1. Global Weight Loss and Weight Management Market Analysis By Diet: Introduction |

| 3.4.2. Market Trend, Analysis and Forecast, By Diet, 2021-2032 |

| 3.4.2.1. Meals |

| 3.4.2.2. Beverages |

| 3.4. Global Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Application, 2021-2032 |

| 3.4.1. Global Weight Loss and Weight Management Market Analysis By Application: Introduction |

| 3.4.2. Market Trend, Analysis and Forecast, By Application, 2021-2032 |

| 3.4.2.1. Weight Maintenance |

| 3.4.2.2. Body Shaping |

| 3.4.2.3. Sports Injuries |

| 3.4.2.4. Aesthetic Procedures |

| 3.4.2.5. Chronic Wound management |

| 3.4. Global Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Age, 2021-2032 |

| 3.4.1. Global Weight Loss and Weight Management Market Analysis By Age: Introduction |

| 3.4.2. Market Trend, Analysis and Forecast, By Age, 2021-2032 |

| 3.4.2.1. Children |

| 3.4.2.2. Adult |

| 3.4.2.3. Senior Citizens |

| 3.5. Global Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Distribution Channel, 2021-2032 |

| 3.5.1. Global Weight Loss and Weight Management Market Analysis by Distribution Channel: Introduction |

| 3.5.2. Market Trend, Analysis and Forecast, By Distribution Channel, 2021-2032 |

| 3.5.2.1. Retail Distributor |

| 3.5.2.2. Health and Beauty Stores |

| 3.5.2.3. Online Channels |

| 3.6. Global Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Region, 2021-2032 |

| 3.6.1. Global Weight Loss and Weight Management Market Analysis by Region : Introduction |

| 3.6.2. Market Trend, Analysis and Forecast, By Region , 2021-2032 |

| 3.6.2.1. North America |

| 3.6.2.2. Europe |

| 3.6.2.4. APAC |

| 3.6.2.5. Latin America |

| 3.6.2.6. Middle East & Africa |

| 4. North America Weight Loss and Weight Management Market Outlook and Future Prospects, 2021-2032 |

| 4.1. North America Weight Loss and Weight Management Market Analysis, 2021-2023 |

| 4.2. North America Weight Loss and Weight Management Market Opportunity and Forecast, 2025-2032 |

| 4.3. North America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Type, 2021-2032 |

| 4.3.1. Equipment |

| 4.3.1.1. Fitness Equipment |

| 4.3.1.2. Equipment |

| 4.3.2. Services |

| 4.3.2.1. Consulting Services |

| 4.3.2.2. Fitness Centers |

| 4.3.2.3. Online Weight Loss Programs |

| 4.3.2.4. Supplement |

| 4.4. North America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Diet, 2021-2032 |

| 4.4.1. Meals |

| 4.4.2. Beverages |

| 4.5. North America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Application, 2021-2032 |

| 4.5.1. Weight Maintenance |

| 4.5.2. Body Shaping |

| 4.5.3. Sports Injuries |

| 4.5.4. Aesthetic Procedures |

| 4.5.5. Chronic Wound Management |

| 4.6. North America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Age, 2021-2032 |

| 4.6.1. Children |

| 4.6.2. Adults |

| 4.6.3. Senior Citizens |

| 4.7. North America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Distribution Channel, 2021-2032 |

| 4.7.1. Retail Distributor |

| 4.7.2. Health and Beauty Stores |

| 4.7.3. Online Channels |

| 4.8. North America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 4.8.1. U.S. |

| 4.8.2. Canada |

| 5. Europe Weight Loss and Weight Management Market Outlook and Future Prospects, 2021-2032 |

| 5.1. Europe Weight Loss and Weight Management Market Analysis, 2021-2023 |

| 5.2. Europe Weight Loss and Weight Management Market Opportunity and Forecast, 2025-2032 |

| 5.3. Europe Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Type, 2021-2032 |

| 5.3.1. Equipment |

| 5.3.1.1. Fitness Equipment |

| 5.3.1.2. Equipment |

| 5.3.2. Services |

| 5.3.2.1. Consulting Services |

| 5.3.2.2. Fitness Centers |

| 5.3.2.3. Online Weight Loss Programs |

| 5.3.2.4. Supplement |

| 5.4. North America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Diet, 2021-2032 |

| 5.4.1. Meals |

| 5.4.2. Beverages |

| 5.5. North America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Application, 2021-2032 |

| 5.5.1. Weight Maintenance |

| 5.5.2. Body Shaping |

| 5.5.3. Sports Injuries |

| 5.5.4. Aesthetic Procedures |

| 5.5.5. Chronic Wound Management |

| 5.6. North America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Age, 2021-2032 |

| 5.6.1. Children |

| 5.6.2. Adults |

| 5.6.3. Senior Citizens |

| 5.7. North America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Distribution Channel, 2021-2032 |

| 5.7.1. Retail Distributor |

| 5.7.2. Health and Beauty Stores |

| 5.7.3. Online Channels |

| 5.8. Europe Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 5.8.1. Germany |

| 5.8.2. UK |

| 5.8.3. France |

| 5.8.4. Spain |

| 5.8.5. Italy |

| 5.8.6. Denmark |

| 5.8.7. Rest of Europe |

| 6. Asia Pacific Weight Loss and Weight Management Market Outlook and Future Prospects, 2021-2032 |

| 6.1. Asia Pacific Weight Loss and Weight Management Market Analysis, 2021-2023 |

| 6.2. Asia Pacific Weight Loss and Weight Management Market Opportunity and Forecast, 2026-2032 |

| 6.3. Asia Pacific Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Type, 2021-2032 |

| 6.3.1. Equipment |

| 6.3.1.1. Fitness Equipment |

| 6.3.1.2. Equipment |

| 6.3.2. Services |

| 6.3.2.1. Consulting Services |

| 6.3.2.2. Fitness Centers |

| 6.3.2.3. Online Weight Loss Programs |

| 6.3.2.4. Supplement |

| 6.4. North America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Diet, 2021-2032 |

| 6.4.1. Meals |

| 6.4.2. Beverages |

| 6.5. North America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Application, 2021-2032 |

| 6.5.1. Weight Maintenance |

| 6.5.2. Body Shaping |

| 6.5.3. Sports Injuries |

| 6.5.4. Aesthetic Procedures |

| 6.5.5. Chronic Wound Management |

| 6.6. North America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Age, 2021-2032 |

| 6.6.1. Children |

| 6.6.2. Adults |

| 6.6.3. Senior Citizens |

| 6.7. North America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Distribution Channel, 2021-2032 |

| 6.7.1. Retail Distributor |

| 6.7.2. Health and Beauty Stores |

| 6.7.3. Online Channels |

| 6.8. Asia Pacific Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 6.8.1. China |

| 6.8.2. Japan |

| 6.8.3. India |

| 6.8.4. Australia & New Zealand |

| 6.8.5. South Korea |

| 6.8.6. Singapore |

| 6.8.7. Rest of Asia Pacific |

| 7. Latin America Weight Loss and Weight Management Market Outlook and Future Prospects, 2021-2032 |

| 7.1. Latin America Weight Loss and Weight Management Market Analysis, 2021-2023 |

| 7.2. Latin America Weight Loss and Weight Management Market Opportunity and Forecast, 2027-2032 |

| 7.3. Latin America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Type, 2021-2032 |

| 7.3.1. Equipment |

| 7.3.1.1. Fitness Equipment |

| 7.3.1.2. Equipment |

| 7.3.2. Services |

| 7.3.2.1. Consulting Services |

| 7.3.2.2. Fitness Centers |

| 7.3.2.3. Online Weight Loss Programs |

| 7.3.2.4. Supplement |

| 7.4. North America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Diet, 2021-2032 |

| 7.4.1. Meals |

| 7.4.2. Beverages |

| 7.5. North America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Application, 2021-2032 |

| 7.5.1. Weight Maintenance |

| 7.5.2. Body Shaping |

| 7.5.3. Sports Injuries |

| 7.5.4. Aesthetic Procedures |

| 7.5.5. Chronic Wound Management |

| 7.6. North America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Age, 2021-2032 |

| 7.6.1. Children |

| 7.6.2. Adults |

| 7.6.3. Senior Citizens |

| 7.7. North America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Distribution Channel, 2021-2032 |

| 7.7.1. Retail Distributor |

| 7.7.2. Health and Beauty Stores |

| 7.7.3. Online Channels |

| 7.8. Latin America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 7.8.1. Brazil |

| 7.8.2. Mexico |

| 7.8.3. Colombia |

| 7.8.4. Rest of Latin America |

| 8. Middle East & Africa Weight Loss and Weight Management Market Outlook and Future Prospects, 2021-2032 |

| 8.1. Middle East & Africa Weight Loss and Weight Management Market Analysis, 2021-2023 |

| 8.2. Middle East & Africa Weight Loss and Weight Management Market Opportunity and Forecast, 2028-2032 |

| 8.3. Middle East & Africa Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Type, 2021-2032 |

| 8.3.1. Equipment |

| 8.3.1.1. Fitness Equipment |

| 8.3.1.2. Equipment |

| 8.3.2. Services |

| 8.3.2.1. Consulting Services |

| 8.3.2.2. Fitness Centers |

| 8.3.2.3. Online Weight Loss Programs |

| 8.3.2.4. Supplement |

| 8.4. North America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Diet, 2021-2032 |

| 8.4.1. Meals |

| 8.4.2. Beverages |

| 8.5. North America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Application, 2021-2032 |

| 8.5.1. Weight Maintenance |

| 8.5.2. Body Shaping |

| 8.5.3. Sports Injuries |

| 8.5.4. Aesthetic Procedures |

| 8.5.5. Chronic Wound Management |

| 8.6. North America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Age, 2021-2032 |

| 8.6.1. Children |

| 8.6.2. Adults |

| 8.6.3. Senior Citizens |

| 8.7. North America Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Distribution Channel, 2021-2032 |

| 8.7.1. Retail Distributor |

| 8.7.2. Health and Beauty Stores |

| 8.7.3. Online Channels |

| 8.8. Middle East & Africa Weight Loss and Weight Management Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 8.8.1. GCC Countries |

| 8.8.2. South Africa |

| 8.8.3. Rest of Middle East & Africa |

| 9. Global Weight Loss and Weight Management Market Competitive Landscape, Market Share Analysis, and Company Profiles |

| 9.1. Weight Loss and Weight Management Market Share Analysis, By Company (2024) |

| 9.2. Company Profiles |

| 1. Herbalife |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 2. Jenny Craig, Inc. |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 3. Nutrisystem |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 4. Medifast |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 5. WW International (formerly Weight Watchers) |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 6. Noom |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 7. Beachbody |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 8. Isagenix |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 9. Plexus Worldwide |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 10. Advocare |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 11. Diet-to-Go |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 12. South Beach Diet |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 13. LifeMD |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 14. Retrofit |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 15. Apollo Endosurgery Inc. |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 9.3. Competitive Comparison Matrix |

| 10. Research Methodology |

| 11. Conclusion and Recommendations |