Polyaniline-Based Conductive Coatings Market (Product Type: Emeraldine Base (EB), Emeraldine Salt (ES), Leucoemeraldine, Pernigraniline; Application: EMI/RFI Shielding, Antistatic Coatings, Corrosion Protection, Electrostatic Discharge (ESD) Control, Sensors & Actuators, Flexible Electronics, Energy Storage Devices (e.g., Supercapacitors, Batteries); End-use Industry: Electronics & Electricals, Automotive, Aerospace & Defense, Industrial Equipment, Telecommunication, Healthcare Devices, Energy & Power, Consumer Goods; Key Players: Adarsh Innovations, Aremco Products, Inc., DuPont, Electrolube, FENZI Group, Ferro Corporation, Fujikura Kasei Co., Ltd., Ghiringhelli Mario, Holland Shielding Systems BV, IoLiTec Ionic Liquids Technologies GmbH, Jacques Dubois SAS, MAJR Products Corp., Pedotinks, Sigma-Aldrich (Merck Group), Xaar) – Global Industry Analysis, Size, Share, Growth, Trends, and Forecast, 2024–2032.

Market Outlook for Polyaniline-Based Conductive Coatings (2025)

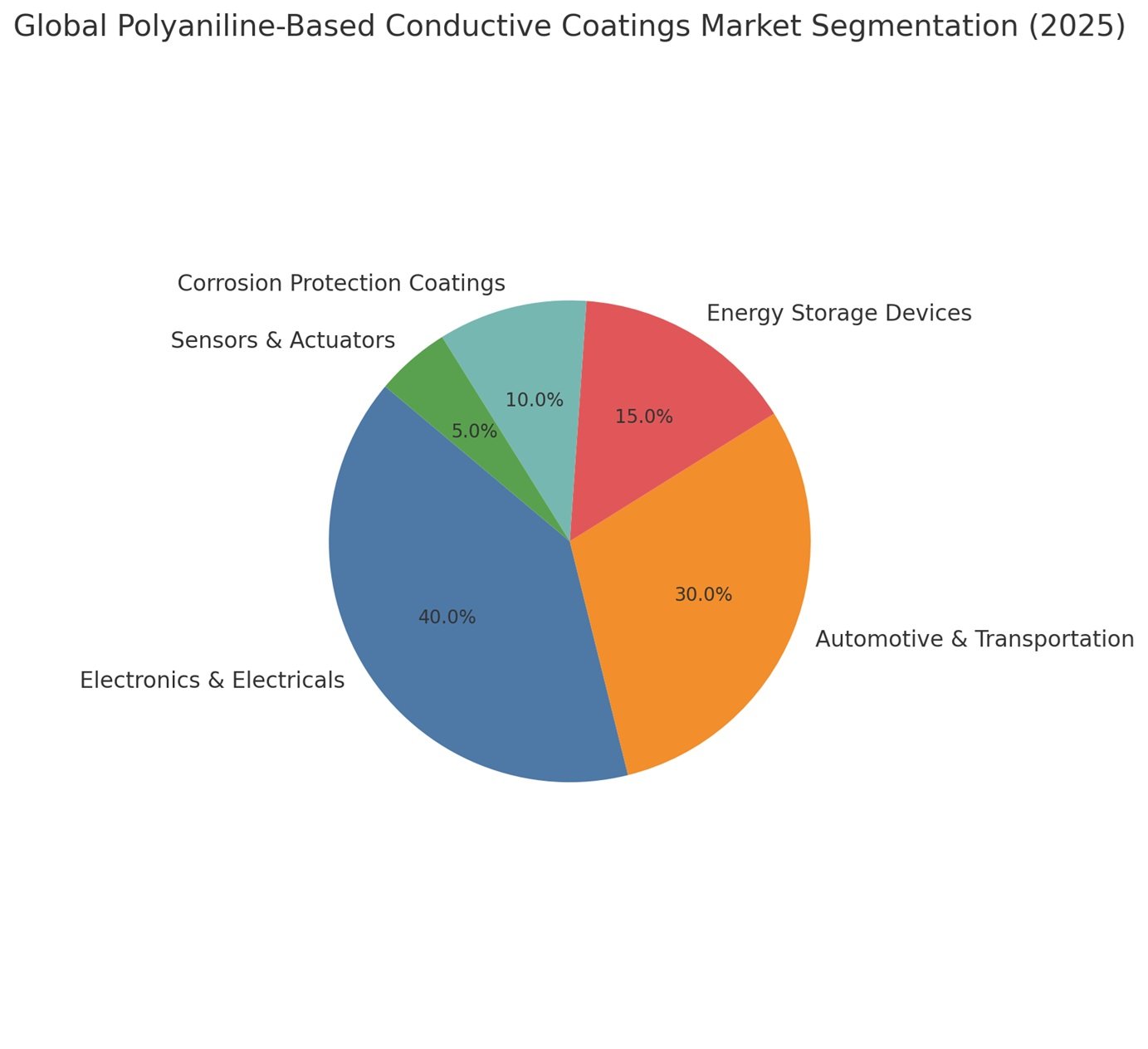

The polyaniline conductive coatings market is poised for robust growth, driven by technological innovation and rising demand in key sectors such as flexible electronics, energy storage, and corrosion protection. The global polyaniline-based conductive coatings market is on a steady growth trajectory, projected to reach USD 67.8 billion by 2032, with a CAGR of 5.0% (2024-2032). Growth is driven by increasing construction activities, rising infrastructure investments, and expanding industrial applications. Key end-use sectors include residential, commercial, automotive, and protective coatings. The material’s lightweight, flexible, and conductive properties make it a prime candidate for next-gen applications—particularly in wearables, EVs, and aerospace. The surge in flexible electronics, with active R&D investments by major players like Google and DuPont, further fuels market momentum.

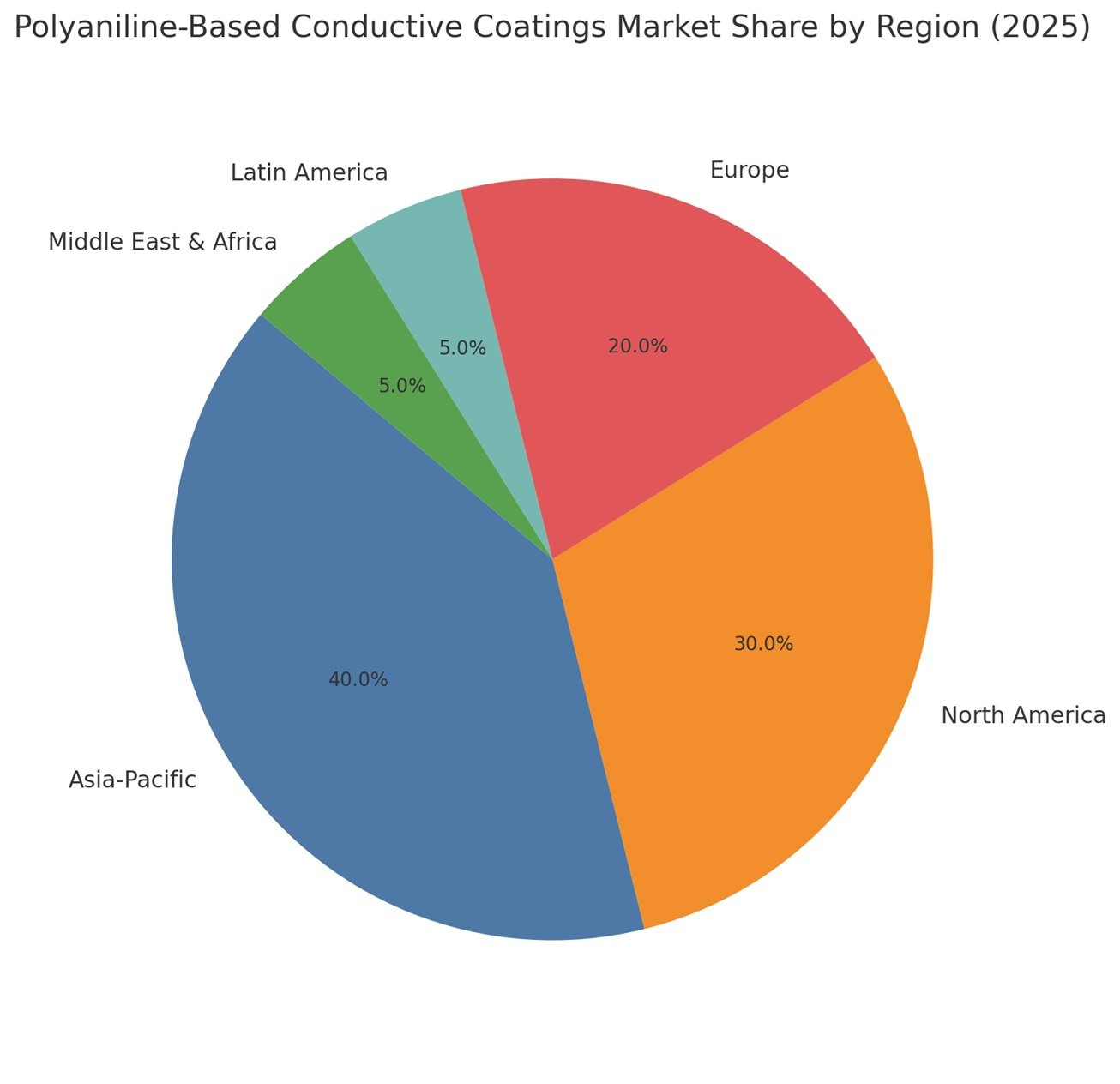

Asia-Pacific dominates (40%) due to its manufacturing prowess and growing EV adoption, while North America and Europe (30% and 20% respectively) drive innovation in aerospace and healthcare. Breakthroughs such as self-healing coatings, printable inks, and hybrid polyaniline-graphene composites showcase ongoing R&D intensity, particularly in Japan, the U.S., and India.

However, challenges remain. Environmental stability and complex processing hinder large-scale commercialization, requiring advancements in formulation and production. Nevertheless, opportunities are expanding—especially in green energy storage and bio-compatible sensor development.

With applications spanning EMI shielding, antistatic coatings, ESD protection, and flexible electronics, the market is increasingly diversified. Players like DuPont, IoLiTec, and Adarsh Innovations are shaping a competitive yet opportunity-rich landscape. Looking ahead, polyaniline’s role in sustainability-aligned sectors will be crucial in defining its commercial trajectory and global adoption.

Driver

Surge in Demand for Flexible and Wearable Electronics

Polyaniline’s lightweight, flexible, and conductive nature makes it ideal for next-generation wearable electronics and flexible devices. With companies like Samsung, Apple, and Xiaomi investing in flexible displays and smart wearables, demand for conductive coatings is growing. In 2024, Google’s acquisition of a flexible battery tech startup underlined the push toward adaptable electronic materials where conductive polymers like polyaniline play a vital role.

- Expansion in EVs and Sustainable Energy Storage

The rise of electric vehicles and energy storage solutions has heightened interest in conductive coatings that enhance battery efficiency and lifespan. In 2023, Tesla and CATL announced R&D into polymer coatings for improved battery conductivity, highlighting opportunities for polyaniline-based materials in supercapacitors and lithium-ion battery components.

- Growing Need for Corrosion-Resistant Coatings in Harsh Environments

Industries such as aerospace, oil & gas, and marine are increasingly adopting corrosion-resistant coatings to protect high-value assets. Polyaniline’s anti-corrosive properties have been validated in recent research by MIT and Indian Institutes of Technology (IITs), making it a preferred alternative to toxic chromium-based coatings.

Restraint

Restraint

High Processing Complexity & Stability Issues

Despite their promising electrical properties, polyaniline coatings face challenges related to environmental stability and batch-to-batch consistency. Maintaining uniform conductivity and mechanical strength under varying environmental conditions limits their use in large-scale commercial applications. For instance, recent industry reports highlight degradation of polyaniline films in humid and oxidative environments, impacting their reliability in consumer electronics and automotive sectors.

Opportunities:

- Rising Demand in Flexible Electronics & Wearables

With the global shift towards flexible and wearable electronics, polyaniline’s flexibility and conductivity make it an ideal candidate. Startups like Xsensio (Switzerland) and innovations in smart fabrics by companies like DuPont are exploring polyaniline-based coatings for sensors and e-textiles. - Adoption in Green Energy Storage Systems

As the renewable energy sector surges, polyaniline’s role in lightweight, conductive electrodes for supercapacitors and batteries is gaining traction. Research from 2024 in Nature Energy showcased improved energy density and cycle life in PANI-based electrodes, aligning with global net-zero goals

Asia-Pacific (40%) remains the dominant market leader, driven by a robust electronics manufacturing ecosystem and rapid adoption of electric vehicles across China, Japan, and South Korea. The region’s industrialization and cost-effective production capabilities offer strategic growth opportunities for suppliers and manufacturers.

North America (30%) maintains a strong R&D-driven position, led by the U.S. aerospace and defense sectors that demand high-performance conductive materials. Innovation pipelines and technology adoption continue to support market expansion.

Europe (20%) reflects steady growth, with Germany and France at the forefront of integrating conductive coatings in automotive and healthcare technologies. Regulatory support for sustainable materials also fuels this segment.

Latin America (5%) and Middle East & Africa (5%) are emerging markets, seeing gradual adoption due to infrastructure development and industrial modernization, particularly in Brazil, Argentina, UAE, and South Africa.

Recent Advancements

| Year | Advancement / Breakthrough | Description & Significance | Region / Institution / Company |

| 2025 | Development of Self-Healing Polyaniline Coatings | Polyaniline infused with nanocapsules that self-repair micro-cracks, enhancing durability in harsh environments. | National Institute for Materials Science (Japan) |

| 2024 | Printable Polyaniline Conductive Inks for Flexible Electronics | Enabled low-cost production of printed circuit components on flexible substrates. | DuPont & IoLiTec GmbH (Germany) |

| 2023 | Hybrid Coatings with Polyaniline and Graphene Oxide | Improved conductivity and mechanical strength for EMI shielding and aerospace use. | Indian Institute of Science (IISc) & IIT Bombay (India) |

| 2023 | Polyaniline Nanotube Integration in Battery Electrodes | Enhanced charge transfer efficiency and stability in energy storage applications. | University of California, Berkeley (USA) |

| 2022 | Bio-Compatible Conductive Polyaniline for Wearable Health Sensors | Advanced coating for non-invasive, skin-contact medical sensors with high conductivity. | MIT Media Lab (USA) |

| 2021 | Superhydrophobic Conductive Polyaniline Coatings | Enabled dual-function coatings for corrosion resistance and antistatic performance. | Shanghai Jiao Tong University (China) |

| 2020 | Green Synthesis of Polyaniline using Plant Extracts | Introduced eco-friendly and scalable synthesis of conductive polymers without harsh chemicals. | CSIR-NCL Pune (India) & University of Delhi |

By Product Type:

- Emeraldine Base (EB)

- Emeraldine Salt (ES)

- Leucoemeraldine

- Pernigraniline

By Application:

- EMI/RFI Shielding

- Antistatic Coatings

- Corrosion Protection

- Electrostatic Discharge (ESD) Control

- Sensors & Actuators

- Flexible Electronics

- Energy Storage Devices (e.g., Supercapacitors, Batteries)

By End-use Industry:

- Electronics & Electricals

- Automotive

- Aerospace & Defense

- Industrial Equipment

- Telecommunication

- Healthcare Devices

- Energy & Power

- Consumer Goods

Competitve Landscape

Adarsh Innovations

Aremco Products, Inc.

DuPont

Electrolube

FENZI Group

Ferro Corporation

Fujikura Kasei Co., Ltd.

Ghiringhelli Mario

Holland Shielding Systems BV

IoLiTec Ionic Liquids Technologies GmbH

Jacques Dubois SAS

MAJR Products Corp.

Pedotinks

Sigma-Aldrich (Merck Group)

Xaar

FAQ

- What is driving the demand for polyaniline in flexible and wearable electronics?

Polyaniline’s lightweight, flexible, and conductive properties make it ideal for smart wearables and flexible electronics, with major tech companies investing heavily in these applications. - How is polyaniline contributing to electric vehicles and energy storage systems?

Polyaniline enhances battery conductivity and lifespan, making it suitable for use in supercapacitors and lithium-ion battery components, supporting EV and green energy growth. - Why is polyaniline preferred in corrosion-resistant coatings?

Its anti-corrosive properties offer a safer alternative to chromium-based coatings, protecting assets in aerospace, oil & gas, and marine industries. - What challenges does the polyaniline market face?

Key challenges include processing complexity, environmental stability, and batch consistency, which affect large-scale commercial adoption. - Which regions dominate the polyaniline conductive coating market?

Asia-Pacific leads with 40% market share, followed by North America (30%) and Europe (20%), driven by electronics manufacturing and R&D investments. - What are the emerging applications of polyaniline coatings?

Applications include EMI/RFI shielding, antistatic coatings, corrosion protection, sensors, ESD control, flexible electronics, and energy storage devices. - What recent innovations have boosted polyaniline usage?

Breakthroughs include self-healing coatings, printable conductive inks, hybrid coatings with graphene oxide, and bio-compatible formulations for health sensors. - Who are the major players in the polyaniline conductive coatings market?

Key companies include DuPont, IoLiTec, Electrolube, Sigma-Aldrich (Merck), Aremco Products, and Xaar, among others. - How is polyaniline used in healthcare devices?

It’s used in wearable health sensors due to its high conductivity and skin-safe formulations, enabling real-time health monitoring. - What product types of polyaniline are commercially available?

Main types include Emeraldine Base (EB), Emeraldine Salt (ES), Leucoemeraldine, and Pernigraniline, each suited for different applications.

Table of Contents

Executive Summary

Industry Introduction, including Taxonomy and Market Definition

Market Trends and Success Factors, including Macro-economic Factors, Market Dynamics, and Recent Industry Developments

Global Market Demand Analysis 2020 to 2024 and Forecast 2025 to 2035, including Historical Analysis and Future Projections

Pricing Analysis

Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- By Product Type

- By Application

- By End-use Industry

- By Region

Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Product Type

- Emeraldine Base (EB)

- Emeraldine Salt (ES)

- Leucoemeraldine

- Pernigraniline

Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Application

- EMI/RFI Shielding

- Antistatic Coatings

- Corrosion Protection

- Electrostatic Discharge (ESD) Control

- Sensors & Actuators

- Flexible Electronics

- Energy Storage Devices (e.g., Supercapacitors, Batteries)

Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By End-use Industry

- Electronics & Electricals

- Automotive

- Aerospace & Defense

- Industrial Equipment

- Telecommunication

- Healthcare Devices

- Energy & Power

- Consumer Goods

Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia Pacific

- Middle East and Africa

North America Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

Latin America Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

Western Europe Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

Eastern Europe Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

East Asia Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

South Asia Pacific Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

Middle East and Africa Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

Sales Forecast 2025 to 2035 by Product Type, Application, and End-use Industry for 30 Countries

Competition Outlook, including Market Structure Analysis, Company Share Analysis by Key Players, and Competition Dashboard

Company Profile

- Adarsh Innovations

- Aremco Products, Inc.

- DuPont

- Electrolube

- FENZI Group

- Ferro Corporation

- Fujikura Kasei Co., Ltd.

- Ghiringhelli Mario

- Holland Shielding Systems BV

- IoLiTec Ionic Liquids Technologies GmbH

- Jacques Dubois SAS

- MAJR Products Corp.

- Pedotinks

- Sigma-Aldrich (Merck Group)

- Xaar