Stoma Care Market (Product Type: Ostomy Bags [One-Piece Systems, Two-Piece Systems], Ostomy Accessories [Skin Barriers, Adhesive Removers, Pouch Covers]; Surgery Type: Colostomy, Ileostomy, Urostomy; End-user: Hospitals and Specialty Clinics, Home Care Settings, Ambulatory Surgical Centers) – Global Industry Analysis, Size, Share, Growth, Trends, and Forecast, 2024-2032.

Market Outlook

The global stoma care market is projected to witness significant growth, driven by increasing awareness of ostomy care and a rising prevalence of inflammatory bowel diseases (IBD) and colorectal cancer. Valued at approximately $3.21 million in 2024, the market is expected to grow at a compound annual growth rate (CAGR) of 5.4% from 2025 to 2032, reaching around $5.98 billion by 2032. As the world continues to age and become afflicted ever more with conditions warranting surgical interventions, the stoma-care market in effect is large enough to deserve attention. Case projections for colorectal cancers will rise as phenomenally as 3.2 million cases by the year 2040, therefore contributing to the growth of the industry. Favorable reimbursement policies in developed countries are also improving the accessibility of patients, thus aiding market value. From advanced pouching systems to improved skin barriers, technology in stoma care has enhanced usability and added share to grow with stronger momentum. These positive trends toward home care environments also stimulate industrial growth. With health systems worldwide now laying more emphasis on effective solutions for managing stoma, this creates a robust forecast for the market that turns into a strong opportunity for industry growth.

Drivers

Increasing Prevalence of Inflammatory Bowel Diseases (IBD): The increasing incidence of IBD, particularly Crohn’s disease and ulcerative colitis, is an important trend impacting the stoma care market. The CDC indicates an estimated prevalence of IBD in the U.S. of between 2.4 and 3.1 million individuals, thus increasing the demand for ostomy procedures and care products. This trend is also being observed in Canada, where a prevalence of 825 per 100,000 population serves to further boost the market.

Aging Population: The increasing number of elderly people worldwide has translated into rising demand for stoma care products. The older the individuals, the more vulnerable they are to diseases that would cause ostomy surgery, for example, colorectal cancer. The American Cancer Society reported more than 101,000 new cases of colon cancer diagnosed in 2019, creating an even larger patient pool requiring efficient stoma care.

Technological Advancements: Innovation in stoma care products has exponentially increased both patient comfort and product efficacy. What really matters is the update in pouching systems and user-friendly design, which have upped satisfaction among the patients and the healthcare providers. To illustrate, the modern ostomy appliances are developed to minimize odour and control pH so as to hinder skin infections, propelling up their acceptance rate.

Restraints

Limited Awareness and Education: There is still a lack of education on ostomy care in patients and health care providers even after improved product development. Poor education in stoma management may lead to complications and poor quality of life in ostomates. Campaigns should be organized to make the public aware of these needs and improve the practices of ostomy care in an effective manner by governmental and non-profit organizations.

Opportunities

Expansion into Emerging Markets: Emerging markets provide numerous opportunities for growth as their healthcare infrastructures are improving rapidly. Therefore, ostomy care generating awareness in countries like India and China would allow taking advantage of specific offering.

Development of Personalized Stoma Care Solutions: This rising trend towards personalized medicine definitely now offers manufacturers the chance to begin production of custom slated-care products to enhance the requirements of individual patients. Innovations such as adjustable pouching systems to allow for differing body shapes and sizes could mean greater user satisfaction and experience.

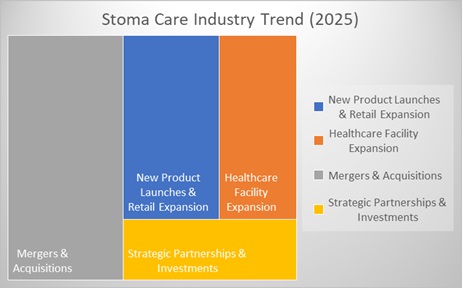

The stoma-care market is seeing significant consolidation with M&A activities (around 40% of the market growth) driving the development of the industry. Duke Street’s acquisition of ForLife Group, Oakmed, and Trio Healthcare shows an increasing interest by investors with specialized ostomy care solutions. The aim of these acquisitions is to increase market reach and improve product offerings, thereby enhancing competition.

Innovation in products (25%) has a direct bearing on consumer accessibility, for instance, the launch of stoma-friendly knickers by Marks & Spencer heralding the way mainstream retail increasingly participates in patient care. This swing reduces stigma and fosters inclusion toward ostomy wear.

In addition, the growth of healthcare facilities (20%), as illustrated by Noble Hospitals’ stoma care OPD, points to rising demand for such specialized post-surgical care. Strategic partnerships (15%) such as the ongoing collaboration between GHD and ForLife stabilize and innovate the supply chain.

On the whole, the market is anticipated to grow steadily owing to acquisitions, retail innovation, and the expanding care infrastructure, highlighting strong investment potential and increasing patient-centric solutions.

Competitive Landscape

Competitive Landscape

Coloplast Corp.

Hollister Incorporated

ConvaTec Inc.

- Braun Melsungen AG

Salts Healthcare Ltd.

Welland Medical Ltd.

Cymed Healthcare

Nu-Hope Laboratories, Inc.

Marlen Manufacturing & Development Co.

Flexicare Group Limited

Alcare Co. Ltd.

Torbot Group, Inc.

Schena Ostomy Technologies, Inc.

Perma-Type Company, Inc.

Safe n Simple

Recent Advances

- In July 2024, Coloplast has launched Heylo, which is the world’s first digital leakage notification system, to help stoma patients relieve anxiety and enhance their quality of life. This Bluetooth-enabled, smartphone-connected system monitors possible leakages to reduce their occurrences by 82%, thereby taking away fear from daily lives. Coloplast also aims to offer personalized care options to stoma patients.

- In June 2024, The STomacARe For Improvement reSearcH (STARFISH) study characterized stoma care challenges in four LMICs using mixed methods. Data from 446 patients included representation of care mix, outcomes and post-operative stoma counseling diversity. Gaps in knowledge, access and affordability of stoma care supplies were identified, culminating in a questionnaire developed towards facilitative task sharing among the experts.

Regional Advancements

- US: In April 2024, Convatec introduced the Esteem Body with Leak Defense in the US, addressing the global demand for soft convexity ostomy barriers. The system offered a comprehensive portfolio of pouching solutions, including drainable, closed-end, and urostomy options. It featured eight key characteristics, including tension location and convex depth, along with a patented ‘body’ pouch.

- UK: In August 2024, M&S launched its first high street Stoma Knickers in collaboration with Colostomy UK. This innovative product, featuring an internal pocket, provided style, comfort, and support for over 200,000 stoma patients in the UK. The collection aimed to offer everyday style and was made available online and in selected stores starting that month.

- Australia: In December 2024, Australia’s Far West Local Health District (FWLHD) launched a chronic and complex wound and stoma care clinic, which operated once a week from Broken Hill Hospital. The clinic provided specialized nursing care for patients with chronic and complex wounds and stomas, including those with colostomies, urostomies, and ileostomies, while also offering remote health services via telehealth appointments.

- Germany: In November 2024, Freudenberg Performance Materials introduced bioresorbable nonwovens for surgical hemostasis management, which offered cost-effective and potentially life-saving benefits. This technology, made from bioresorbable raw materials, was part of Freudenberg’s portfolio that included components for wound treatment, elastic backing materials, incontinence management products, and stoma care filters. The company planned to collaborate with partners to provide solutions for bioactive wound healing, drug release, and regenerative medicine.

Market Segmentation

Segmentation by Product Type

Ostomy Bags

One-Piece Systems

Two-Piece Systems

Ostomy Accessories

Skin Barriers

Adhesive Removers

Pouch Covers

Segmentation by Surgery Type

Colostomy

Ileostomy

Urostomy

Segmentation by End User

Hospitals and Specialty Clinics

Home Care Settings

Ambulatory Surgical Centers (ASCs)

FAQs

- What is driving the growth of the global stoma care market?

The market is growing due to the rising prevalence of colorectal cancer and inflammatory bowel diseases (IBD), an aging population, and technological advancements in ostomy products.

- What is the market size and projected growth rate?

The market is valued at $3.21 billion in 2024 and is expected to reach $5.98 billion by 2032, growing at a CAGR of 5.4%.

- How is innovation shaping the stoma care industry?

New technologies like Coloplast’s Heylo leakage notification system and customized pouching solutions are improving patient comfort and usability.

- What are the major restraints affecting market growth?

Limited awareness and education on ostomy care can lead to complications and hinder adoption, particularly in low- and middle-income countries.

- What opportunities exist in emerging markets?

Rising healthcare infrastructure in India and China presents significant growth potential for stoma care products.

- How are mergers and acquisitions impacting the market?

Consolidation is increasing, with Duke Street acquiring ForLife Group, Oakmed, and Trio Healthcare to expand market reach and enhance product offerings.

- Which companies dominate the stoma care market?

Key players include Coloplast, Hollister, ConvaTec, B. Braun, Salts Healthcare, and Welland Medical.

- What recent advancements are making an impact?

M&S launched stoma-friendly knickers, while Convatec introduced Esteem Body with Leak Defense for enhanced ostomy management.

- What are the key market segments?

The market is segmented by product type (ostomy bags, accessories), surgery type (colostomy, ileostomy, urostomy), and end users (hospitals, home care, ASCs).

- How are healthcare facilities supporting ostomy patients?

Hospitals and specialized clinics, like Noble Hospitals’ stoma care OPD in India, are expanding services to provide better post-surgical care.

Table Of Content

| 1. Executive Summary |

| 1.1. Definition |

| 1.2. Research Scope |

| 1.3. Key Findings by Major Segments |

| 2. Global Stoma Care Market Overview |

| 2.1. Stoma Care Market Dynamics |

| 2.1.1. Drivers |

| 2.1.2. Opportunities |

| 2.1.3. Restraints |

| 2.1.4. Challenges |

| 2.2. Product and Pricing Analysis |

| 2.3. Technological Advancements |

| 2.4. Key Industry Updates |

| 2.5. Regulatory Scenario by Region/ Countries |

| 2.6. Porters Five Forces Analysis |

| 3. Global Stoma Care Market Outlook and Future Prospects, 2021-2032 |

| 3.1. Global Stoma Care Market Analysis, 2021-2023 |

| 3.2. Global Stoma Care Market Opportunity and Forecast, 2025-2032 |

| 3.3. Global Stoma Care Market Analysis, Opportunity and Forecast, By Product Type, 2021-2032 |

| 3.3.1. Global Stoma Care Market Analysis by Product Type: Introduction |

| 3.3.2. Market Trend, Analysis and Forecast, By Product Type, 2021-2032 |

| 3.3.2.1. Ostomy Bags |

| 3.3.2.1.1. One-Piece Systems |

| 3.3.2.1.2. Two-Piece Systems |

| 3.3.2.2. Ostomy Accessories |

| 3.3.2.2. Skin Barriers |

| 3.3.2.2. Adhesive Removers |

| 3.3.2.2. Pouch Covers |

| 3.4. Global Stoma Care Market Analysis, Opportunity and Forecast, By Surgery Type, 2021-2032 |

| 3.4.1. Global Stoma Care Market Analysis By Surgery Type: Introduction |

| 3.4.2. Market Trend, Analysis and Forecast, By Surgery Type, 2021-2032 |

| 3.4.2.1. Colostomy |

| 3.4.2.2. Ileostomy |

| 3.4.2.3. Urostomy |

| 3.5. Global Stoma Care Market Analysis, Opportunity and Forecast, By End-user, 2021-2032 |

| 3.5.1. Global Stoma Care Market Analysis by End-user: Introduction |

| 3.5.2. Market Trend, Analysis and Forecast, By End-user, 2021-2032 |

| 3.5.2.1. Hospitals and Specialty Clinics |

| 3.5.2.2. Health and Beauty Stores |

| 3.5.2.3. Ambulatory Surgical Centers (ASCs) |

| 3.6. Global Stoma Care Market Analysis, Opportunity and Forecast, By Region, 2021-2032 |

| 3.6.1. Global Stoma Care Market Analysis by Region: Introduction |

| 3.6.2. Market Trend, Analysis and Forecast, By Region, 2021-2032 |

| 3.6.2.1. North America |

| 3.6.2.2. Europe |

| 3.6.2.4. APAC |

| 3.6.2.5. Latin America |

| 3.6.2.6. Middle East & Africa |

| 4. North America Stoma Care Market Outlook and Future Prospects, 2021-2032 |

| 4.1. North America Stoma Care Market Analysis, 2021-2023 |

| 4.2. North America Stoma Care Market Opportunity and Forecast, 2025-2032 |

| 4.3. North America Stoma Care Market Analysis, Opportunity and Forecast, By Product Type, 2021-2032 |

| 4.3.1. Ostomy Bags |

| 4.3.1.1. One-Piece Systems |

| 4.3.1.2. Two-Piece Systems |

| 4.3.2. Ostomy Accessories |

| 4.3.2.1. Skin Barriers |

| 4.3.2.2. Adhesive Removers |

| 4.3.2.3. Pouch Covers |

| 4.4. North America Stoma Care Market Analysis, Opportunity and Forecast, By Surgery Type, 2021-2032 |

| 4.4.1. Colostomy |

| 4.4.2. Ileostomys |

| 4.4.3. Urostomy |

| 4.5. North America Stoma Care Market Analysis, Opportunity and Forecast, By End-user, 2021-2032 |

| 4.5.1. Hospitals and Specialty Clinics |

| 4.5.2. Health and Beauty Stores |

| 4.5.3. Ambulatory Surgical Centers (ASCs) |

| 4.6. North America Stoma Care Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 4.6.1. U.S. |

| 4.6.2. Canada |

| 5. Europe Stoma Care Market Outlook and Future Prospects, 2021-2032 |

| 5.1. Europe Stoma Care Market Analysis, 2021-2023 |

| 5.2. Europe Stoma Care Market Opportunity and Forecast, 2025-2032 |

| 5.3. Europe Stoma Care Market Analysis, Opportunity and Forecast, By Product Type, 2021-2032 |

| 5.3.1. Ostomy Bags |

| 5.3.1.1. One-Piece Systems |

| 5.3.1.2. Two-Piece Systems |

| 5.3.2. Ostomy Accessories |

| 5.3.2.1. Skin Barriers |

| 5.3.2.2. Adhesive Removers |

| 5.3.2.3. Pouch Covers |

| 5.4. North America Stoma Care Market Analysis, Opportunity and Forecast, By Surgery Type, 2021-2032 |

| 5.4.1. Colostomy |

| 5.4.2. Ileostomys |

| 5.4.3. Urostomy |

| 5.5. North America Stoma Care Market Analysis, Opportunity and Forecast, By End-user, 2021-2032 |

| 5.5.1. Hospitals and Specialty Clinics |

| 5.5.2. Health and Beauty Stores |

| 5.5.3. Ambulatory Surgical Centers (ASCs) |

| 5.6. Europe Stoma Care Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 5.6.1. Germany |

| 5.6.2. UK |

| 5.6.3. France |

| 5.6.4. Spain |

| 5.6.5. Italy |

| 5.6.6. Denmark |

| 5.6.7. Rest of Europe |

| 6. Asia Pacific Stoma Care Market Outlook and Future Prospects, 2021-2032 |

| 6.1. Asia Pacific Stoma Care Market Analysis, 2021-2023 |

| 6.2. Asia Pacific Stoma Care Market Opportunity and Forecast, 2026-2032 |

| 6.3. Asia Pacific Stoma Care Market Analysis, Opportunity and Forecast, By Product Type, 2021-2032 |

| 6.3.1. Ostomy Bags |

| 6.3.1.1. One-Piece Systems |

| 6.3.1.2. Two-Piece Systems |

| 6.3.2. Ostomy Accessories |

| 6.3.2.1. Skin Barriers |

| 6.3.2.2. Adhesive Removers |

| 6.3.2.3. Pouch Covers |

| 6.4. North America Stoma Care Market Analysis, Opportunity and Forecast, By Surgery Type, 2021-2032 |

| 6.4.1. Colostomy |

| 6.4.2. Ileostomys |

| 6.4.3. Urostomy |

| 6.5. North America Stoma Care Market Analysis, Opportunity and Forecast, By End-user, 2021-2032 |

| 6.5.1. Hospitals and Specialty Clinics |

| 6.5.2. Health and Beauty Stores |

| 6.5.3. Ambulatory Surgical Centers (ASCs) |

| 6.6. Asia Pacific Stoma Care Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 6.6.1. China |

| 6.6.2. Japan |

| 6.6.3. India |

| 6.6.4. Australia & New Zealand |

| 6.6.5. South Korea |

| 6.6.6. Singapore |

| 6.6.7. Rest of Asia Pacific |

| 7. Latin America Stoma Care Market Outlook and Future Prospects, 2021-2032 |

| 7.1. Latin America Stoma Care Market Analysis, 2021-2023 |

| 7.2. Latin America Stoma Care Market Opportunity and Forecast, 2027-2032 |

| 7.3. Latin America Stoma Care Market Analysis, Opportunity and Forecast, By Product Type, 2021-2032 |

| 7.3.1. Ostomy Bags |

| 7.3.1.1. One-Piece Systems |

| 7.3.1.2. Two-Piece Systems |

| 7.3.2. Ostomy Accessories |

| 7.3.2.1. Skin Barriers |

| 7.3.2.2. Adhesive Removers |

| 7.3.2.3. Pouch Covers |

| 7.4. North America Stoma Care Market Analysis, Opportunity and Forecast, By Surgery Type, 2021-2032 |

| 7.4.1. Colostomy |

| 7.4.2. Ileostomys |

| 7.4.3. Urostomy |

| 7.5. North America Stoma Care Market Analysis, Opportunity and Forecast, By End-user, 2021-2032 |

| 7.5.1. Hospitals and Specialty Clinics |

| 7.5.2. Health and Beauty Stores |

| 7.5.3. Ambulatory Surgical Centers (ASCs) |

| 7.6. Latin America Stoma Care Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 7.6.1. Brazil |

| 7.6.2. Mexico |

| 7.6.3. Colombia |

| 7.6.4. Rest of Latin America |

| 8. Middle East & Africa Stoma Care Market Outlook and Future Prospects, 2021-2032 |

| 8.1. Middle East & Africa Stoma Care Market Analysis, 2021-2023 |

| 8.2. Middle East & Africa Stoma Care Market Opportunity and Forecast, 2028-2032 |

| 8.3. Middle East & Africa Stoma Care Market Analysis, Opportunity and Forecast, By Product Type, 2021-2032 |

| 8.3.1. Ostomy Bags |

| 8.3.1.1. One-Piece Systems |

| 8.3.1.2. Two-Piece Systems |

| 8.3.2. Ostomy Accessories |

| 8.3.2.1. Skin Barriers |

| 8.3.2.2. Adhesive Removers |

| 8.3.2.3. Pouch Covers |

| 8.4. North America Stoma Care Market Analysis, Opportunity and Forecast, By Surgery Type, 2021-2032 |

| 8.4.1. Colostomy |

| 8.4.2. Ileostomys |

| 8.4.3. Urostomy |

| 8.5. North America Stoma Care Market Analysis, Opportunity and Forecast, By End-user, 2021-2032 |

| 8.5.1. Hospitals and Specialty Clinics |

| 8.5.2. Health and Beauty Stores |

| 8.5.3. Ambulatory Surgical Centers (ASCs) |

| 8.6. Middle East & Africa Stoma Care Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 8.6.1. GCC Countries |

| 8.6.2. South Africa |

| 8.6.3. Rest of Middle East & Africa |

| 9. Global Stoma Care Market Competitive Landscape, Market Share Analysis, and Company Profiles |

| 9.1. Stoma Care Market Share Analysis, By Company (2024) |

| 9.2. Company Profiles |

| 1. Coloplast Corp. |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 2. Hollister Incorporated |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 3. ConvaTec Inc. |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 4. B. Braun Melsungen AG |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 5. Salts Healthcare Ltd. |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 6. Welland Medical Ltd. |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 7. Cymed Healthcare |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 8. Nu-Hope Laboratories, Inc. |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 9. Marlen Manufacturing & Development Co. |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 10. Flexicare Group Limited |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 11. Alcare Co. Ltd. |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 12. Torbot Group, Inc. |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 13. Schena Ostomy Technologies, Inc. |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 14. Perma-Type Company, Inc. |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 15. Safe n Simple |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 9.3. Competitive Comparison Matrix |

| 10. Research Methodology |

| 11. Conclusion and Recommendations |