Market Outlook

The global biologics market is witnessing substantial growth, driven by evolving industry trends and increasing demand for targeted therapies. With a market size of approximately $468.74 billion in 2024, the sector is projected to expand significantly, reaching $1,019.37 billion by 2032 at a CAGR of 15.3% from 2025 to 2032. This market forecast highlights the impact of rising chronic disease prevalence, advancements in biotechnology, and an expanding pipeline of innovative biologic products.

Key market trends include the growing adoption of personalized medicine, the integration of companion diagnostics, and the increasing approval of biosimilars, which are improving treatment accessibility and affordability. Additionally, the market share of biologics in therapeutic areas such as oncology and autoimmune diseases continues to expand, driven by their superior efficacy compared to conventional treatments.

Despite stringent regulatory challenges and intellectual property concerns that may slow market entry, ongoing R&D investments and strategic partnerships are fostering innovation. The biologics industry outlook remains promising, with strong opportunities for stakeholders to leverage emerging trends and market expansion strategies to drive future growth.

Drivers of the Biologics Market

Rising Prevalence of Chronic Diseases: The increasing incidence of chronic diseases, such as cancer, diabetes, and autoimmune disorders, is a significant driver for the biologics market. For instance, the American Cancer Society estimated approximately 1.92 million new cancer cases in the U.S. alone in 2022, contributing to a growing demand for effective biologic therapies like monoclonal antibodies and immunotherapies that enhance survival rates and minimize side effects.

Technological Advancements in Drug Development: Continuous innovations in biotechnology, including advancements in genetic engineering and recombinant DNA technology, are facilitating the development of targeted biologic therapies. For example, the emergence of advanced drug delivery systems has improved the efficacy and safety profiles of biologics.

Increasing Acceptance and Demand for Biosimilars: The growing acceptance of biosimilars—biologic products that are highly similar to already approved reference products—has expanded treatment options for patients and healthcare providers. As patents for original biologics expire, biosimilars offer cost-effective alternatives that can enhance accessibility to biologic therapies. This shift is expected to significantly contribute to market growth, with the biosimilars segment projected to grow rapidly over the coming years

| Company & Facility | Investment & Expansion | Market Trends & Forecast |

| Johnson & Johnson (North Carolina, USA) | $2 billion investment in a biologics manufacturing facility in Wilson, North Carolina, starting construction in 2025. | Expanding market share in oncology, immunology, and neuroscience biologics, aligning with the growing global biologics industry forecasted to reach $750 billion+ by 2032. |

| Syngene International (Bangalore, India) | Upgraded biologics facility (Unit 3) set to be operational in late 2024, tripling its biomanufacturing capacity. | Reflects the rising demand for contract biologics manufacturing, with the global biopharma CDMO market expected to grow at a CAGR of 9.9%. |

| BeiGene (Princeton, USA) | Opened a flagship biologics manufacturing and R&D facility, boosting commercial-stage biologic pharmaceutical production. | Strengthening BeiGene’s foothold in the oncology biologics segment, part of a rapidly growing cancer biologics market, estimated to exceed $200 billion by 2030. |

| Kyowa Kirin (Sanford, North Carolina, USA) | Investing up to $530 million in a new biologics facility to expand North American manufacturing capabilities. | Indicates increased biologics manufacturing investments in the U.S., driven by rising demand for monoclonal antibodies and cell & gene therapies. |

| Aurobindo Pharma (India) | Auro Vaccines investing ₹300 crore in biologics manufacturing, strengthening India’s biologics production capabilities. | Highlights India’s growing share in the biologics contract manufacturing industry, projected to witness a CAGR of 11-14% in the next decade. |

Restraints in Market Growth

The biologics market is shaped by stringent regulatory requirements that impact market trends, growth forecasts, and industry expansion. Regulatory bodies like the FDA and EMA mandate extensive clinical trials, increasing time-to-market and development costs. The biosimilars segment faces additional hurdles in proving similarity and interchangeability, limiting market penetration.The complex manufacturing processes introduce variability, necessitating process validation and optimization, further influencing market size and scalability. Additionally, temperature-controlled logistics add to distribution challenges, impacting the supply chain.With biologics being a global industry, regulatory harmonization remains a challenge, affecting market access across regions. Companies must navigate intellectual property issues, as patent expirations open doors for biosimilar competition, yet high manufacturing costs and regulatory barriers limit entry.Frequent regulatory updates add compliance burdens, affecting industry growth and innovation. These factors collectively influence biologics market share, competitive landscape, and long-term forecasts.

Intellectual Property Issues: The expiration of patents for leading biologic drugs can lead to increased competition from biosimilars, impacting revenues for original developers. Companies may face challenges in protecting their intellectual property rights, leading to potential revenue losses as cheaper alternatives enter the market

Opportunities in the Biologics Market

Expansion of Personalized Medicine: There is a growing trend towards personalized medicine, which tailors treatments based on individual patient characteristics, including genetic makeup and disease profile. This approach enhances treatment efficacy and minimizes adverse effects, creating opportunities for novel biologic therapies designed for specific patient populations. Companies investing in personalized biologics are likely to gain a competitive edge as healthcare shifts towards more individualized treatment strategies

Innovative Research and Development Initiatives: Ongoing investment in R&D by major pharmaceutical companies presents significant opportunities within the biologics market. For instance, companies like Amgen and Roche are actively developing new biologic therapies targeting various diseases, including cancer and autoimmune disorders. The strong pipeline of innovative biologic drugs is expected to drive market growth as these products move closer to commercialization

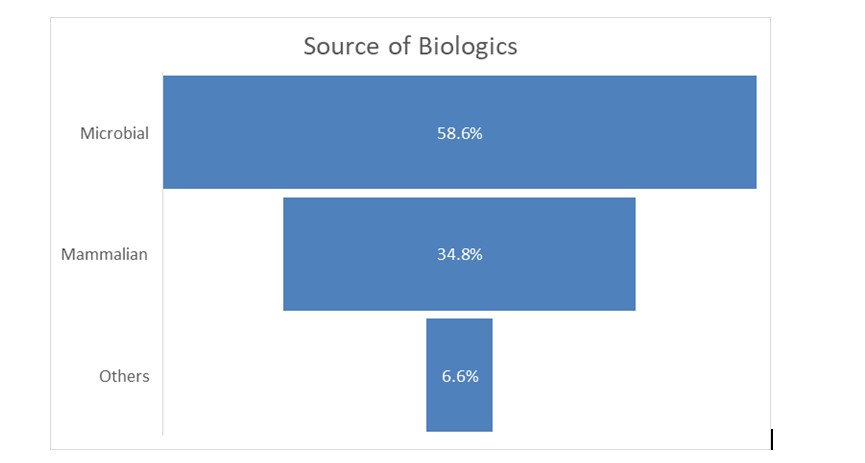

Microbial expression systems dominate biologics production, holding 58.6% of the market in 2024, primarily due to their cost-effectiveness and scalability. Products like recombinant insulin and granulocyte-macrophage colony-stimulating factor are widely produced using microbial fermentation, with ongoing advancements enhancing efficiency.

Mammalian cell cultures, particularly CHO (Chinese Hamster Ovary) cells, are essential for complex biologics like monoclonal antibodies. Companies like Lonza and Samsung Biologics are expanding capacity, while Fujifilm Diosynth invested $1.2 billion in 2024 to scale up mammalian bioreactors.

Alternative sources, including plant-based biologics (“plantibodies”) and insect cell lines, are gaining traction. While plantibodies offer cost advantages, they remain in early development. Insect cell systems, like baculovirus expression, are increasingly used for vaccines and complex protein production.The biologics market continues to evolve, driven by innovation in microbial and mammalian systems, with emerging sources offering promising alternatives.

Competitive Landscape

Pfizer

Amgen

Sanofi

GSK (GlaxoSmithKline)

Biocon

Lonza Group Ltd

Boehringer Ingelheim Group

Fujifilm Diosynth Biotechnologies

Samsung Biologics

Wuxi Biologics

Atara Biotherapeutics

CanSino Biologics

Epygen Biotech

BioMarin Pharmaceutical

Celltrion

Recent Advances

- In December 2024, Mankind Pharma and Innovent Biologics announced a strategic partnership to expand the market share of sintilimab, an advanced immunotherapy drug, in India. Marketed as Tyvyt (sintilimab injection) in China, this drug has been a key player in the immunotherapy industry since its launch in 2018, with eight approved indications and a strong presence in the market. The collaboration reflects the growing trend of international licensing agreements to meet the rising demand for innovative cancer treatments. With the Indian oncology market projected to grow significantly, this partnership is expected to contribute to market expansion, offering patients access to a proven treatment option. Mankind Pharma will handle registration, import, marketing, sales, and distribution in India, while Innovent Biologics will oversee manufacturing and supply, positioning the drug for long-term success in the region.

- In line with industry trends, Roche has advanced its position in the oncology market by securing FDA acceptance for its supplemental Biologics License Application (sBLA) for Columvi, a combination of glofitamab, gemcitabine, and oxaliplatin, targeting relapsed or refractory diffuse large B-cell lymphoma (DLBCL). This development aligns with the growing market size of bispecific antibody therapies, as Columvi is part of Roche’s CD20xCD3 bispecific antibody program. The application is backed by positive results from the Phase III STARGLO study, which demonstrated a significant improvement in overall survival compared to MabThera/Rituxan and GemOx. With the FDA’s decision anticipated by July 20, 2025, the approval could expand Roche’s market share in the lymphoma treatment segment and shape future forecasts for immunotherapy advancements.

- In December 2024, Qu Biologics Inc. reported promising trends in cancer immunotherapy, demonstrating significant advancements in survival rates through a combination of Site-Specific Immunomodulators (SSIs) and CAR T-cell therapy. The study, conducted in collaboration with the Yong Loo Lin School of Medicine at the National University of Singapore, highlighted a notable market opportunity in overcoming challenges associated with CAR T-cell therapy in solid tumors, where poor infiltration and immune suppression have limited efficacy. With an impressive 80% survival rate after 31 days of treatment, this breakthrough is expected to impact the industry landscape, driving market growth and expanding the market size for innovative immunotherapy solutions. The forecast for this sector remains strong, as increasing demand for effective cancer treatments continues to shape the market share of next-generation immunotherapies.

- In December 2024, Biocon Biologics, a subsidiary of Biocon, was recognized as an industry leader in intellectual property (IP) trends, securing a spot on the prestigious Asia IP Elite 2024 list by Intellectual Asset Management. This marks the eighth consecutive year that Biocon and its subsidiary have been acknowledged for their strategic IP value creation, reinforcing their market share in the biopharmaceutical sector. As one of only two Indian pharmaceutical companies among the 93 featured, Biocon Biologics continues to shape the industry’s future, reflecting strong growth forecasts and increasing influence in the region’s evolving IP landscape.

Market Segmentation

Segmentation by Product

- Monoclonal Antibodies

- Vaccines

- Recombinant Proteins

- Cell Therapy

- Gene Therapy

- Antisense, RNAi, & Molecular Therapy

- Others

Segmentation by Application

- Oncology

- Infectious Diseases

- Immunology

- Cardiovascular Disorders

- Hematological Disorders

- Rare Diseases

- Others

Segmentation by Source

- Microbial Sources

- Mammalian Sources

- Others

Segmentation by Route of Administration

- Injectable Biologics

- Subcutaneous

- Intravenous

- Oral Biologics

- Topical Biologics

Segmentation by End-user

- Hospitals

- Research Institutions

- Specialty Clinics

FAQ

What is driving the growth of the biologics market?

The rising prevalence of chronic diseases, technological advancements in drug development, and increasing acceptance of biosimilars are key growth drivers.

How are biosimilars impacting the biologics market?

Biosimilars provide cost-effective alternatives to original biologics, expanding treatment accessibility and driving market growth.

Which companies are making significant investments in biologics manufacturing?

Companies like Johnson & Johnson, Syngene International, BeiGene, Kyowa Kirin, and Aurobindo Pharma are heavily investing in biologics facilities.

What are the major restraints in the biologics market?

Stringent regulatory requirements, complex manufacturing processes, intellectual property challenges, and high development costs limit market expansion.

What opportunities exist in the biologics market?

The expansion of personalized medicine, innovative R&D initiatives, and advancements in microbial and mammalian cell cultures present significant opportunities.

Which expression systems dominate biologics production?

Microbial expression systems hold 58.6% of the market, with mammalian cell cultures, plant-based biologics, and insect cell systems also gaining traction.

What are some recent advancements in biologics?

Notable developments include Mankind Pharma’s partnership with Innovent Biologics, Roche’s FDA submission for Columvi, and Qu Biologics’ promising cancer immunotherapy research.

Which companies are leading in the biologics market?

Key players include Pfizer, Amgen, Sanofi, GSK, Biocon, Lonza Group, Boehringer Ingelheim, Fujifilm Diosynth, Samsung Biologics, and Wuxi Biologics.

What are the main segments of the biologics market?

Biologics are segmented by product (monoclonal antibodies, vaccines, cell & gene therapy), application (oncology, infectious diseases), source (microbial, mammalian), and administration route.

What trends are shaping the future of the biologics market?

The market is driven by increasing investments, the rise of biosimilars, advancements in personalized medicine, and regulatory challenges affecting market access.

Table Of Content

| 1. Executive Summary |

| 1.1. Definition |

| 1.2. Research Scope |

| 1.3. Key Findings by Major Segments |

| 2. Global Biologics Market Overview |

| 2.1. Biologics Market Dynamics |

| 2.1.1. Drivers |

| 2.1.2. Opportunities |

| 2.1.3. Restraints |

| 2.1.4. Challenges |

| 2.2. Pipeline Analysis |

| 2.3. Value Chain Analysis |

| 2.4. Key Industry Updates |

| 2.5. Regulatory Scenario by Region/ Countries |

| 2.6. Porters Five Forces Analysis |

| 3. Global Biologics Market Outlook and Future Prospects, 2021-2032 |

| 3.1. Global Biologics Market Analysis, 2021-2023 |

| 3.2. Global Biologics Market Opportunity and Forecast, 2025-2032 |

| 3.3. Global Biologics Market Analysis, Opportunity and Forecast, By Type, 2021-2032 |

| 3.3.1. Global Biologics Market Analysis by Type: Introduction |

| 3.3.2. Market Trend, Analysis and Forecast, By Type, 2021-2032 |

| 3.3.2.1. Monoclonal Antibodies |

| 3.3.2.2. Recombinant Proteins |

| 3.3.2.3. Vaccines |

| 3.3.2.4. Cell Therapy |

| 3.3.2.5. Gene Therapies |

| 3.3.2.6. Antisense, RNAi, & Molecular Therapy |

| 3.3.2.7. Others |

| 3.4. Global Biologics Market Analysis, Opportunity and Forecast, By Application, 2021-2032 |

| 3.4.1. Global Biologics Market Analysis by Application: Introduction |

| 3.4.2. Market Trend, Analysis and Forecast, By Application, 2021-2032 |

| 3.4.2.1. Oncology |

| 3.4.2.2. Immunology |

| 3.4.2.3. Cardiology |

| 3.4.2.4. Neurology |

| 3.4.2.5. Respiratory |

| 3.4.2.6. Endocrinology |

| 3.4.2.7. Infectious diseases |

| 3.4.2.8. Others |

| 3.5. Global Biologics Market Analysis, Opportunity and Forecast, By Source, 2021-2032 |

| 3.5.1. Global Biologics Market Analysis by Source: Introduction |

| 3.5.2. Market Trend, Analysis and Forecast, By Source, 2021-2032 |

| 3.5.2.1. Microbial Sources |

| 3.5.2.2. Mammalian Sources |

| 3.5.2.3. Others |

| 3.6. Global Biologics Market Analysis, Opportunity and Forecast, By Route of Administration, 2021-2032 |

| 3.6.1. Global Biologics Market Analysis by Route of Administration: Introduction |

| 3.6.2. Market Trend, Analysis and Forecast, By Route of Administration, 2021-2032 |

| 3.6.2.1. Injectable Biologics |

| 3.6.2.1.1. Subcutaneous |

| 3.6.2.1.2. Intravenous |

| 3.6.2.2. Oral Biologics |

| 3.6.2.3. Topical Biologics |

| 3.7. Global Biologics Market Analysis, Opportunity and Forecast, By End-user, 2021-2032 |

| 3.7.1. Global Biologics Market Analysis by End-user: Introduction |

| 3.7.2. Market Trend, Analysis and Forecast, By End-user, 2021-2032 |

| 3.7.2.1. Hospital |

| 3.7.2.2. Research Institutions |

| 3.7.2.3. Specialty Clinics |

| 3.8. Global Biologics Market Analysis, Opportunity and Forecast, By Region, 2021-2032 |

| 3.8.1. Global Biologics Market Analysis by Region : Introduction |

| 3.8.2. Market Trend, Analysis and Forecast, By Region , 2021-2032 |

| 3.8.2.1. North America |

| 3.8.2.2. Europe |

| 3.8.2.4. APAC |

| 3.8.2.5. Latin America |

| 3.8.2.6. Middle East & Africa |

| 4. North America Biologics Market Outlook and Future Prospects, 2021-2032 |

| 4.1. North America Biologics Market Analysis, 2021-2023 |

| 4.2. North America Biologics Market Opportunity and Forecast, 2025-2032 |

| 4.3. North America Biologics Market Analysis, Opportunity and Forecast, By Type, 2021-2032 |

| 4.3.1. Monoclonal Antibodies |

| 4.3.2. Recombinant Proteins |

| 4.3.3. Vaccines |

| 4.3.4. Cell Therapy |

| 4.3.5. Gene Therapies |

| 4.3.6. Antisense, RNAi, & Molecular Therapy |

| 4.3.7. Others |

| 4.4. North America Biologics Market Analysis, Opportunity and Forecast, By Application, 2021-2032 |

| 4.4.1. Oncology |

| 4.4.2. Immunology |

| 4.4.3. Cardiology |

| 4.4.4. Neurology |

| 4.4.5. Respiratory |

| 4.4.6. Endocrinology |

| 4.4.7. Infectious disease |

| 4.4.8. Others |

| 4.5. North America Biologics Market Analysis, Opportunity and Forecast, By Sources, 2021-2032 |

| 4.5.1. Microbial Sources |

| 4.5.2. Mammalian Sources |

| 4.5.3. Others |

| 4.6. North America Biologics Market Analysis, Opportunity and Forecast, By Route of Administration, 2021-2032 |

| 4.6.1. Injectable Biologics |

| 4.6.1.1. Subcutaneous |

| 4.6.1.2. Intravenous |

| 4.6.2. Oral Biologics |

| 4.6.3. Topical Biologics |

| 4.7. North America Biologics Market Analysis, Opportunity and Forecast, By End-user, 2021-2032 |

| 4.7.1. Hospital |

| 4.7.2. Research Institutions |

| 4.7.3. Specialty Clinics |

| 4.8. North America Biologics Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 4.8.1. U.S. |

| 4.8.2. Canada |

| 5. Europe Biologics Market Outlook and Future Prospects, 2021-2032 |

| 5.1. Europe Biologics Market Analysis, 2021-2023 |

| 5.2. Europe Biologics Market Opportunity and Forecast, 2025-2032 |

| 5.3. Europe Biologics Market Analysis, Opportunity and Forecast, By Type, 2021-2032 |

| 5.3.1. Monoclonal Antibodies |

| 5.3.2. Recombinant Proteins |

| 5.3.3. Vaccines |

| 5.3.4. Cell Therapy |

| 5.3.5. Gene Therapies |

| 5.3.6. Antisense, RNAi, & Molecular Therapy |

| 5.3.7. Others |

| 5.4. Europe Biologics Market Analysis, Opportunity and Forecast, By Application, 2021-2032 |

| 5.4.1. Oncology |

| 5.4.2. Immunology |

| 5.4.3. Cardiology |

| 5.4.4. Neurology |

| 5.4.5. Respiratory |

| 5.4.6. Endocrinology |

| 5.4.7. Infectious disease |

| 5.4.8. Others |

| 5.5. North America Biologics Market Analysis, Opportunity and Forecast, By Sources, 2021-2032 |

| 5.5.1. Microbial Sources |

| 5.5.2. Mammalian Sources |

| 5.5.3. Others |

| 5.6. North America Biologics Market Analysis, Opportunity and Forecast, By Route of Administration, 2021-2032 |

| 5.6.1. Injectable Biologics |

| 5.6.1.1. Subcutaneous |

| 5.6.1.2. Intravenous |

| 5.6.2. Oral Biologics |

| 5.6.3. Topical Biologics |

| 5.7. Europe Biologics Market Analysis, Opportunity and Forecast, By End-user, 2021-2032 |

| 5.7.1. Hospital |

| 5.7.2. Research Institutions |

| 5.7.3. Specialty Clinics |

| 5.8. Europe Biologics Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 5.8.1. Germany |

| 5.8.2. UK |

| 5.8.3. France |

| 5.8.4. Spain |

| 5.8.5. Italy |

| 5.8.6. Denmark |

| 5.8.7. Rest of Europe |

| 6. Asia Pacific Biologics Market Outlook and Future Prospects, 2021-2032 |

| 6.1. Asia Pacific Biologics Market Analysis, 2021-2023 |

| 6.2. Asia Pacific Biologics Market Opportunity and Forecast, 2026-2032 |

| 6.3. Asia Pacific Biologics Market Analysis, Opportunity and Forecast, By Type, 2021-2032 |

| 6.3.1. Monoclonal Antibodies |

| 6.3.2. Recombinant Proteins |

| 6.3.3. Vaccines |

| 6.3.4. Cell Therapy |

| 6.3.5. Gene Therapies |

| 6.3.6. Antisense, RNAi, & Molecular Therapy |

| 6.3.7. Others |

| 6.4. Asia Pacific Biologics Market Analysis, Opportunity and Forecast, By Application, 2021-2032 |

| 6.4.1. Oncology |

| 6.4.2. Immunology |

| 6.4.3. Cardiology |

| 6.4.4. Neurology |

| 6.4.5. Respiratory |

| 6.4.6. Endocrinology |

| 6.4.7. Infectious disease |

| 6.4.8. Others |

| 6.5. North America Biologics Market Analysis, Opportunity and Forecast, By Sources, 2021-2032 |

| 6.5.1. Microbial Sources |

| 6.5.2. Mammalian Sources |

| 6.5.3. Others |

| 6.6. North America Biologics Market Analysis, Opportunity and Forecast, By Route of Administration, 2021-2032 |

| 6.6.1. Injectable Biologics |

| 6.6.1.1. Subcutaneous |

| 6.6.1.2. Intravenous |

| 6.6.2. Oral Biologics |

| 6.6.3. Topical Biologics |

| 6.7. Asia Pacific Biologics Market Analysis, Opportunity and Forecast, By End-user, 2021-2032 |

| 6.7.1. Hospital |

| 6.7.2. Research Institutions |

| 6.7.3. Specialty Clinics |

| 6.8. Asia Pacific Biologics Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 6.8.1. China |

| 6.8.2. Japan |

| 6.8.3. India |

| 6.8.4. Australia & New Zealand |

| 6.8.5. South Korea |

| 6.8.6. Singapore |

| 6.8.7. Rest of Asia Pacific |

| 7. Latin America Biologics Market Outlook and Future Prospects, 2021-2032 |

| 7.1. Latin America Biologics Market Analysis, 2021-2023 |

| 7.2. Latin America Biologics Market Opportunity and Forecast, 2027-2032 |

| 7.3. Latin America Biologics Market Analysis, Opportunity and Forecast, By Type, 2021-2032 |

| 7.3.1. Monoclonal Antibodies |

| 7.3.2. Recombinant Proteins |

| 7.3.3. Vaccines |

| 7.3.4. Cell Therapy |

| 7.3.5. Gene Therapies |

| 7.3.6. Antisense, RNAi, & Molecular Therapy |

| 7.3.7. Others |

| 7.4. Latin America Biologics Market Analysis, Opportunity and Forecast, By Application, 2021-2032 |

| 7.4.1. Oncology |

| 7.4.2. Immunology |

| 7.4.3. Cardiology |

| 7.4.4. Neurology |

| 7.4.5. Respiratory |

| 7.4.6. Endocrinology |

| 7.4.7. Infectious disease |

| 7.4.8. Others |

| 7.5. North America Biologics Market Analysis, Opportunity and Forecast, By Sources, 2021-2032 |

| 7.5.1. Microbial Sources |

| 7.5.2. Mammalian Sources |

| 7.5.3. Others |

| 7.6. North America Biologics Market Analysis, Opportunity and Forecast, By Route of Administration, 2021-2032 |

| 7.6.1. Injectable Biologics |

| 7.6.1.1. Subcutaneous |

| 7.6.1.2. Intravenous |

| 7.6.2. Oral Biologics |

| 7.6.3. Topical Biologics |

| 7.7. Latin America Biologics Market Analysis, Opportunity and Forecast, By End-user, 2021-2032 |

| 7.7.1. Hospital |

| 7.7.2. Research Institutions |

| 7.7.3. Specialty Clinics |

| 7.8. Latin America Biologics Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 7.8.1. Brazil |

| 7.8.2. Mexico |

| 7.8.3. Colombia |

| 7.8.4. Rest of Latin America |

| 8. Middle East & Africa Biologics Market Outlook and Future Prospects, 2021-2032 |

| 8.1. Middle East & Africa Biologics Market Analysis, 2021-2023 |

| 8.2. Middle East & Africa Biologics Market Opportunity and Forecast, 2028-2032 |

| 8.3. Middle East & Africa Biologics Market Analysis, Opportunity and Forecast, By Type, 2021-2032 |

| 8.3.1. Monoclonal Antibodies |

| 8.3.2. Recombinant Proteins |

| 8.3.3. Vaccines |

| 8.3.4. Cell Therapy |

| 8.3.5. Gene Therapies |

| 8.3.6. Antisense, RNAi, & Molecular Therapy |

| 8.3.7. Others |

| 8.4. Middle East & Africa Biologics Market Analysis, Opportunity and Forecast, By Application, 2021-2032 |

| 8.4.1. Oncology |

| 8.4.2. Immunology |

| 8.4.3. Cardiology |

| 8.4.4. Neurology |

| 8.4.5. Respiratory |

| 8.4.6. Endocrinology |

| 8.4.7. Infectious disease |

| 8.4.8. Others |

| 8.5. North America Biologics Market Analysis, Opportunity and Forecast, By Sources, 2021-2032 |

| 8.5.1. Microbial Sources |

| 8.5.2. Mammalian Sources |

| 8.5.3. Others |

| 8.6. North America Biologics Market Analysis, Opportunity and Forecast, By Route of Administration, 2021-2032 |

| 8.6.1. Injectable Biologics |

| 8.6.1.1. Subcutaneous |

| 8.6.1.2. Intravenous |

| 8.6.2. Oral Biologics |

| 8.6.3. Topical Biologics |

| 8.7. Middle East & Africa Biologics Market Analysis, Opportunity and Forecast, By End-user, 2021-2032 |

| 8.7.1. Hospital |

| 8.7.2. Research Institutions |

| 8.7.3. Specialty Clinics |

| 8.8. Middle East & Africa Biologics Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 8.8.1. GCC Countries |

| 8.8.2. South Africa |

| 8.8.3. Rest of Middle East & Africa |

| 9. Global Biologics Market Competitive Landscape, Market Share Analysis, and Company Profiles |

| 9.1. Biologics Market Share Analysis, By Company (2024) |

| 9.2. Company Profiles |

| 1. Pfizer |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 2. Amgen |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 3. Sanofi |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 4. GSK (GlaxoSmithKline) |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 5. Biocon |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 6. Lonza Group Ltd |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 7. Boehringer Ingelheim Group |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 8. Fujifilm Diosynth Biotechnologies |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 9. Samsung Biologics |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 10. Wuxi Biologics |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 11. Atara Biotherapeutics |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 12. CanSino Biologics |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 13. Epygen Biotech |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 14. BioMarin Pharmaceutical |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 15. Celltrion |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 9.3. Competitive Comparison Matrix |

| 10. Research Methodology |

| 11. Conclusion and Recommedations |