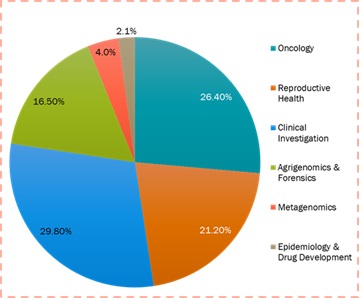

DNA Sequencing Market: Product (Consumables, Instruments, Services); Technology (Sanger Sequencing, Next-Generation Sequencing (NGS), Third-Generation Sequencing, Targeted Sequencing); Application (Oncology, Reproductive Health, Clinical Investigation, Agrigenomics & Forensics, Metagenomics, Epidemiology & Drug Development); End User (Hospitals & Clinics, Academic Research Institutions, Clinical Research Organizations (CROs)).

Market Outlook

The DNA sequencing market is poised for significant expansion, with an estimated size of $13,156 million in 2024 and a projected CAGR of 17.8%, reaching $33,275 million by 2032. The field has witnessed transformative advancements, driven by Next-Generation Sequencing (NGS), long-read sequencing, and multiomics integration. Innovations like Roche’s SBX technology and Illumina’s NovaSeq X are enhancing scalability, speed, and precision in genomic analysis. Rising demand for personalized medicine and increased research funding are key growth drivers, enabling applications in oncology, reproductive health, infectious disease diagnostics, and agrigenomics. Despite challenges in data management, opportunities in direct-to-consumer genetic testing and agricultural genomics are expanding. With AI-powered analytics and national biobank initiatives accelerating discoveries, DNA sequencing remains at the forefront of precision medicine and scientific innovation. As industry breakthroughs continue, the market is expected to reshape healthcare, agriculture, and environmental sciences on a global scale.

Market Driver

Technological Advancements

The field of DNA sequencing has undergone transformative advancements, with Next-Generation Sequencing (NGS) revolutionizing genetic analysis through enhanced efficiency, precision, and affordability. Once a niche research tool, sequencing is now a cornerstone of modern biology and medicine. Roche’s Sequencing by Expansion (SBX), announced in February 2025, offers ultra-rapid, high-throughput sequencing, addressing scalability challenges in genomics. Spatial biology is also evolving, with in situ sequencing enabling large-scale, cost-effective genomic studies at the cellular level, while multiomics integration combines genetic, epigenetic, and transcriptomic data for deeper biological insights. Long-read sequencing technologies from PacBio and Oxford Nanopore enhance genomic research, particularly in personalized medicine. Illumina’s NovaSeq X sets new standards in high-throughput sequencing, supporting applications like cancer genomics. Industry breakthroughs are anticipated at the AGBT 2025 conference, where innovations in NGS and multiomics will further drive genomic research and healthcare advancements.

Rising Demand for Personalized Medicine

Healthcare is shifting towards a more tailored approach, focusing on treatments designed specifically for individual genetic makeups. Personalized medicine harnesses DNA sequencing to uncover genetic variations that can influence disease progression or treatment responses. This patient-centric model has spurred a heightened demand for robust genomic data, emphasizing the role of sequencing in identifying key mutations or biomarkers. Such insights are invaluable in treating complex conditions, like cancer or rare genetic disorders, where precision can significantly improve outcomes.

Increased Research Funding

Investment in genomics and DNA sequencing has surged, driven by global recognition of its transformative potential. Governments and private sectors are actively funding advancements, accelerating technological innovation and expanding applications across healthcare, agriculture, and environmental science. Next-Generation Sequencing (NGS) has become more accessible due to cost reductions and increased throughput, enabling large-scale studies in spatial biology and disease research. The integration of AI and machine learning enhances data analysis, expediting biomarker discovery and drug development. National biobank initiatives are fueling precision medicine by leveraging large genomic datasets to identify disease-related genetic variants. Market projections indicate substantial growth, with DNA sequencing expected to reach new milestones in revenue and adoption. Long-read sequencing technologies, such as PacBio’s HiFi sequencing, provide high-accuracy genomic insights at lower costs. As funding and innovation continue to expand, DNA sequencing remains at the forefront of medical breakthroughs, scientific discovery, and personalized healthcare.

Restraints Hindering DNA Sequencing Technology Adoption

- Complex Data Management Challenges

DNA sequencing generates massive datasets that require advanced bioinformatics tools for processing and interpretation. The sheer complexity of managing and analyzing this data presents a significant challenge. Institutions without access to specialized personnel, robust computational infrastructure, or data storage solutions may struggle to keep pace with technological advancements. Hiring skilled bioinformaticians and investing in powerful analytics software can be overwhelming, especially for newcomers. The fear of misinterpreting crucial genomic insights or encountering bottlenecks in workflow efficiency often deters adoption.

Opportunity for DNA Sequencing Market

- Direct-to-Consumer Genetic Testing Revolution

Imagine unlocking the secrets of your genetic code with just a simple test—this is the promise of direct-to-consumer (DTC) genetic testing services. Companies like 23andMe have made genetic insights not only accessible but also incredibly popular. As consumers become more curious about their ancestry, health predispositions, and even personalized wellness strategies, the demand for DNA sequencing services is soaring. This growing consumer interest creates an incredible opportunity for market players to cater to a tech-savvy audience eager for actionable genomic insights. By streamlining testing processes, offering user-friendly results, and integrating cutting-edge technologies like AI, companies can tap into this fast-evolving market.

- Transformative Applications in Agriculture and Environmental Science

Beyond the human genome, DNA sequencing is unlocking possibilities in agriculture and environmental science. Imagine crops genetically analyzed for enhanced yield, resistance to diseases, or adaptation to climate change. Or envision a future where biodiversity is monitored at the molecular level, helping combat ecological challenges and track environmental shifts. DNA sequencing’s versatility is reshaping these industries, creating new revenue streams and opportunities for innovation.

The DNA sequencing industry is experiencing strong growth, driven by advancements in next-generation sequencing (NGS) and its expanding applications across multiple sectors. Oncology remains a dominant segment, with trends indicating increased adoption for cancer diagnosis and targeted therapies, significantly influencing market share. Reproductive health is another key area, where genetic testing for fertility treatments and disorder detection is driving industry expansion. Clinical investigation, including hereditary disorder and infectious disease diagnostics, holds a substantial market share due to the high accuracy and cost-effectiveness of DNA sequencing. Agrigenomics & forensics are emerging segments, contributing to market size growth through innovations in crop improvement and forensic analysis. Metagenomics is gaining traction as demand rises for microbiome studies. Epidemiology & drug development continue to shape market trends by enhancing disease tracking and accelerating drug discovery. With increasing investments and technological advancements, the DNA sequencing market is forecasted to expand significantly in the coming years.

Global Next-Generation Sequencing (NGS) Developments and Their Regional Impact

Global Next-Generation Sequencing (NGS) Developments and Their Regional Impact

- Global Developments

- Roche’s Sequencing by Expansion (SBX) Technology: This breakthrough sequencing technology enhances speed, flexibility, and scalability in DNA sequencing.

- Impact: SBX will accelerate advancements in research and healthcare by providing ultra-fast and highly accurate sequencing, enabling rapid disease diagnosis and genomic research.

- Regional Developments and Impact

North America

- Advancement in Spatial Biology: New high-throughput sequencing technologies are enabling large-scale studies of cellular interactions and disease mechanisms.

- Illumina’s NovaSeq X: This platform leads in high-speed, high-data-output genomic projects.

- Impact: These advancements enhance precision medicine, drug discovery, and disease research, strengthening North America’s dominance in genomic sciences.

Europe

- AI and Multiomics Integration: AI-driven multiomics is improving genomic analysis, offering comprehensive insights into biological systems.

- Roche’s SBX Technology: This innovation is revolutionizing European research and healthcare applications.

- Impact: AI-powered genomics boosts early disease detection, personalized treatment, and scientific innovation, reinforcing Europe’s leadership in precision medicine.

Asia-Pacific

- Growing NGS Adoption: Rising investments in genomics research and personalized medicine are driving demand.

- Portable Sequencing Technologies: Oxford Nanopore Technologies’ portable sequencing solutions provide real-time genetic insights.

- Impact: Increased accessibility to advanced genomics fosters innovation, healthcare advancements, and industry growth, positioning Asia-Pacific as a major genomics hub.

Latin America

- Emerging Genomics Market: Increasing interest in NGS for research and clinical applications.

- Impact: Although still developing, investments in genomics will enhance healthcare capabilities, genetic research, and diagnostics in the region.

Middle East & Africa

- Rising Genomics Focus: Government initiatives and healthcare investments are promoting genomics research.

- Impact: This fosters advancements in disease prevention, diagnosis, and treatment, laying the foundation for future growth in genomic medicine.

Competitive Landscape

Illumina

Thermo Fisher Scientific

Agilent Technologies

QIAGEN

BGI Genomics

Pacific Biosciences (PacBio)

Oxford Nanopore Technologies

Bio-Rad Laboratories

Eurofins Genomics

Takara Bio

- Hoffmann-La Roche Ltd

Beckman Coulter

Swift Biosciences

Genomatix Software GmbH

Ginkgo Bioworks

Recent Advances

- In December 2024, Union Minister Shri Bhupender Yadav inaugurated the Advanced Facility for Pashmina Certification and Next Generation DNA Sequencing Facility at the Wildlife Institute of India (WII) in Dehradun. The facility uses the Next Generation Sequencing Facility for rapid genome decoding, allowing researchers to study genetic diversity, evolutionary relationships, and population health. It also features a dedicated Scanning Electron Microscope for wool testing and certification.

- In October 2024, Researchers at Yale School of Medicine, the Jackson Laboratory, and the Broad Institute of MIT and Harvard University have developed a new generative AI method called Computational Optimization of DNA Activity (CODA) to design synthetic DNA that controls gene expression in cells. CODA could potentially improve gene therapy by rewriting disease-causing mutations, but better methods are needed to deliver therapies directly to diseased cells. The researchers trained their AI model on data from naturally occurring regulatory elements, using over 775,000 different regulatory elements in human blood, liver, and brain cells.

- In August 2024, Illumina plans to establish a Global Capability Center in Bengaluru, India, to boost research and development efforts. The center aims to hire 100 technology professionals by 2024, focusing on healthcare and climate change. Illumina has supported initiatives in India, including the Genome India Project and COVID-19 surveillance. Philanthropic support includes early COVIDSeq collaborations and sequencing capabilities donation.

- In April 2024, Illumina, a leading DNA sequencing and array-based technology company, has received approval from the European Commission for its divestment plan for GRAIL. The company plans to explore divestment through trade sales or capital markets transactions, with potential capitalization of approximately $1 billion. Illumina plans to finalize terms with the EC by the end of 2024, and does not intend to update forward-looking statements or provide interim reports on the current quarter’s progress.

- In January 2024, The UK Health Security Agency (UKHSA) has launched a 5 year Pathogen Genomics Strategy to enhance public health detection and understanding of pathogens. The strategy aims to address seven strategic aims over the next five years, including antimicrobial resistance, emerging infections, biosecurity, and vaccine preventable diseases. UKHSA Chief Executive Professor Dame Jenny Harries highlighted genomics’ role in modern infectious disease control and its effectiveness in preventing hospitalizations and deaths.

Market Segmentation

Segmentation by Product

- Consumables

- Instruments

- Services

Segmentation by Technology

- Sanger Sequencing

- Next-Generation Sequencing (NGS)

- Third-Generation Sequencing

- Targeted Sequencing

Segmentation by Application

- Oncology

- Reproductive Health

- Clinical Investigation

- Agrigenomics & Forensics

- Metagenomics

- Epidemiology & Drug Development

Segmentation by End User

- Hospitals & Clinics

- Academic Research Institutions

- Clinical Research Organizations (CROs)

10 FAQs on DNA Sequencing Market and DNA Sequencing Industry

What is Next-Generation Sequencing (NGS)?

NGS is an advanced DNA sequencing technology that enables rapid, high-throughput genetic analysis with greater efficiency, precision, and affordability.

How is DNA sequencing transforming healthcare?

It enables personalized medicine, cancer diagnostics, and rare disease detection by identifying genetic variations that influence disease progression and treatment response.

What is Roche’s Sequencing by Expansion (SBX) technology?

Announced in February 2025, SBX is an ultra-rapid, high-throughput sequencing method that enhances scalability in genomic research and diagnostics.

How does AI enhance NGS?

AI and machine learning analyze vast sequencing datasets, accelerating biomarker discovery, drug development, and precision medicine.

What are the biggest challenges in adopting DNA sequencing?

Complex data management, high infrastructure costs, and the need for skilled bioinformaticians are major hurdles in sequencing adoption.

What role do biobanks play in genomic research?

National biobank initiatives store vast genetic datasets, helping researchers identify disease-related genetic variants and develop targeted therapies.

How is DNA sequencing used beyond healthcare?

It is applied in agriculture (crop improvement, disease resistance), forensics, and environmental science (biodiversity monitoring, climate adaptation).

Why is direct-to-consumer (DTC) genetic testing growing?

DTC testing by companies like 23andMe offers individuals insights into their ancestry, health predispositions, and personalized wellness strategies.

Which regions are leading in NGS advancements?

North America and Europe lead in precision medicine and AI-driven genomics, while Asia-Pacific is rapidly growing with increased investments and portable sequencing solutions.

What is the market outlook for DNA sequencing?

The market is projected to reach $34.8 billion by 2029, driven by advancements in NGS, personalized medicine, and multiomics integration.

Table Of Content

| 1. Executive Summary |

| 1.1. Definition |

| 1.2. Research Scope |

| 1.3. Key Findings by Major Segments |

| 2. Global Diagnostics DNA Sequencing Market Overview |

| 2.1. Diagnostics DNA Sequencing Market Dynamics |

| 2.1.1. Drivers |

| 2.1.2. Opportunities |

| 2.1.3. Restraints |

| 2.1.4. Challenges |

| 2.2. Product Analysis |

| 2.3. Value Chain Analysis |

| 2.4. Key Industry Updates |

| 2.5. Regulatory Scenario by Region/ Countries |

| 2.6. Porters Five Forces Analysis |

| 3. Global Diagnostics DNA Sequencing Market Outlook and Future Prospects, 2021-2032 |

| 3.1. Global Diagnostics DNA Sequencing Market Analysis, 2021-2023 |

| 3.2. Global Diagnostics DNA Sequencing Market Opportunity and Forecast, 2025-2032 |

| 3.3. Global Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Technology, 2021-2032 |

| 3.3.1. Global Diagnostics DNA Sequencing Market Analysis by Technology: Introduction |

| 3.3.2. Market Trend, Analysis and Forecast, By Technology, 2021-2032 |

| 3.3.2.1. Sanger Sequencing |

| 3.3.2.2. Next-Generation Sequencing (NGS) |

| 3.3.2.3. Third-Generation Sequencing |

| 3.3.2.4. Targeted Sequencing |

| 3.4. Global Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Application, 2021-2032 |

| 3.4.1. Global Diagnostics DNA Sequencing Market Analysis by Application: Introduction |

| 3.4.2. Market Trend, Analysis and Forecast, By Application, 2021-2032 |

| 3.4.2.1. Oncology |

| 3.4.2.2. Reproductive Health |

| 3.4.2.3. Clinical Investigation |

| 3.4.2.4. Agrigenomics & Forensics |

| 3.4.2.5. Metagenomics |

| 3.4.2.6. Epidemiology & Drug Development |

| 3.5. Global Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Product, 2021-2032 |

| 3.5.1. Global Diagnostics DNA Sequencing Market Analysis by Product: Introduction |

| 3.5.2. Market Trend, Analysis and Forecast, By Product, 2021-2032 |

| 3.5.2.1. Consumables |

| 3.5.2.2. Instruments |

| 3.5.2.3. Services |

| 3.6. Global Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By End-user, 2021-2032 |

| 3.6.1. Global Diagnostics DNA Sequencing Market Analysis by End-user: Introduction |

| 3.6.2. Market Trend, Analysis and Forecast, By End-user, 2021-2032 |

| 3.6.2.1. Hospital & Clinnics |

| 3.6.2.2. Research Institutions |

| 3.6.2.3. Clinical Research Organizations (CROs) |

| 3.7. Global Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Region, 2021-2032 |

| 3.7.1. Global Diagnostics DNA Sequencing Market Analysis by Region : Introduction |

| 3.7.2. Market Trend, Analysis and Forecast, By Region , 2021-2032 |

| 3.7.2.1. North America |

| 3.7.2.2. Europe |

| 3.7.2.4. APAC |

| 3.7.2.5. Latin America |

| 3.7.2.6. Middle East & Africa |

| 4. North America Diagnostics DNA Sequencing Market Outlook and Future Prospects, 2021-2032 |

| 4.1. North America Diagnostics DNA Sequencing Market Analysis, 2021-2023 |

| 4.2. North America Diagnostics DNA Sequencing Market Opportunity and Forecast, 2025-2032 |

| 4.3. North America Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Technology, 2021-2032 |

| 4.3.1. Sanger Sequencing |

| 4.3.2. Next-Generation Sequencing (NGS) |

| 4.3.3. Third-Generation Sequencing |

| 4.3.4. Targeted Sequencing |

| 4.4. North America Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Application, 2021-2032 |

| 4.4.1. Oncology |

| 4.4.2. Reproductive Health |

| 4.4.3. Clinical Investigation |

| 4.4.4. Agrigenomics & Forensics |

| 4.4.5. Metagenomics |

| 4.4.6. Epidemiology & Drug Development |

| 4.5. North America Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Sources, 2021-2032 |

| 4.5.1. Consumables |

| 4.5.2. Instruments |

| 4.5.3. Services |

| 4.6. North America Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By End-user, 2021-2032 |

| 4.6.1. Hospital & Clinnics |

| 4.6.2. Research Institutions |

| 4.6.3. Clinical Research Organizations (CROs) |

| 4.7. North America Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 4.7.1. U.S. |

| 4.7.2. Canada |

| 5. Europe Diagnostics DNA Sequencing Market Outlook and Future Prospects, 2021-2032 |

| 5.1. Europe Diagnostics DNA Sequencing Market Analysis, 2021-2023 |

| 5.2. Europe Diagnostics DNA Sequencing Market Opportunity and Forecast, 2025-2032 |

| 5.3. Europe Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Technology, 2021-2032 |

| 5.3.1. Sanger Sequencing |

| 5.3.2. Next-Generation Sequencing (NGS) |

| 5.3.3. Third-Generation Sequencing |

| 5.3.4. Targeted Sequencing |

| 5.4. Europe Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Application, 2021-2032 |

| 5.4.1. Oncology |

| 5.4.2. Reproductive Health |

| 5.4.3. Clinical Investigation |

| 5.4.4. Agrigenomics & Forensics |

| 5.4.5. Metagenomics |

| 5.4.6. Epidemiology & Drug Development |

| 5.5. North America Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Sources, 2021-2032 |

| 5.5.1. Consumables |

| 5.5.2. Instruments |

| 5.5.3. Services |

| 5.6. Europe Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By End-user, 2021-2032 |

| 5.6.1. Hospital & Clinnics |

| 5.6.2. Research Institutions |

| 5.6.3. Clinical Research Organizations (CROs) |

| 5.7. Europe Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 5.7.1. Germany |

| 5.7.2. UK |

| 5.7.3. France |

| 5.7.4. Spain |

| 5.7.5. Italy |

| 5.7.6. Denmark |

| 5.7.6. Rest of Europe |

| 6. Asia Pacific Diagnostics DNA Sequencing Market Outlook and Future Prospects, 2021-2032 |

| 6.1. Asia Pacific Diagnostics DNA Sequencing Market Analysis, 2021-2023 |

| 6.2. Asia Pacific Diagnostics DNA Sequencing Market Opportunity and Forecast, 2026-2032 |

| 6.3. Asia Pacific Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Technology, 2021-2032 |

| 6.3.1. Sanger Sequencing |

| 6.3.2. Next-Generation Sequencing (NGS) |

| 6.3.3. Third-Generation Sequencing |

| 6.3.4. Targeted Sequencing |

| 6.4. Asia Pacific Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Application, 2021-2032 |

| 6.4.1. Oncology |

| 6.4.2. Reproductive Health |

| 6.4.3. Clinical Investigation |

| 6.4.4. Agrigenomics & Forensics |

| 6.4.5. Metagenomics |

| 6.4.6. Epidemiology & Drug Development |

| 6.5. North America Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Sources, 2021-2032 |

| 6.5.1. Consumables |

| 6.5.2. Instruments |

| 6.5.3. Services |

| 6.6. Asia Pacific Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By End-user, 2021-2032 |

| 6.6.1. Hospital & Clinnics |

| 6.6.2. Research Institutions |

| 6.6.3. Clinical Research Organizations (CROs) |

| 6.7. Asia Pacific Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 6.7.1. China |

| 6.7.2. Japan |

| 6.7.3. India |

| 6.7.4. Australia & New Zealand |

| 6.7.5. South Korea |

| 6.7.6. Singapore |

| 6.7.6. Rest of Asia Pacific |

| 7. Latin America Diagnostics DNA Sequencing Market Outlook and Future Prospects, 2021-2032 |

| 7.1. Latin America Diagnostics DNA Sequencing Market Analysis, 2021-2023 |

| 7.2. Latin America Diagnostics DNA Sequencing Market Opportunity and Forecast, 2027-2032 |

| 7.3. Latin America Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Technology, 2021-2032 |

| 7.3.1. Sanger Sequencing |

| 7.3.2. Next-Generation Sequencing (NGS) |

| 7.3.3. Third-Generation Sequencing |

| 7.3.4. Targeted Sequencing |

| 7.4. Latin America Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Application, 2021-2032 |

| 7.4.1. Oncology |

| 7.4.2. Reproductive Health |

| 7.4.3. Clinical Investigation |

| 7.4.4. Agrigenomics & Forensics |

| 7.4.5. Metagenomics |

| 7.4.6. Epidemiology & Drug Development |

| 7.5. North America Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Sources, 2021-2032 |

| 7.5.1. Consumables |

| 7.5.2. Instruments |

| 7.5.3. Services |

| 7.6. Latin America Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By End-user, 2021-2032 |

| 7.6.1. Hospital & Clinnics |

| 7.6.2. Research Institutions |

| 7.6.3. Clinical Research Organizations (CROs) |

| 7.7. Latin America Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 7.7.1. Brazil |

| 7.7.2. Mexico |

| 7.7.3. Colombia |

| 7.7.4. Rest of Latin America |

| 8. Middle East & Africa Diagnostics DNA Sequencing Market Outlook and Future Prospects, 2021-2032 |

| 8.1. Middle East & Africa Diagnostics DNA Sequencing Market Analysis, 2021-2023 |

| 8.2. Middle East & Africa Diagnostics DNA Sequencing Market Opportunity and Forecast, 2028-2032 |

| 8.3. Middle East & Africa Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Technology, 2021-2032 |

| 8.3.1. Sanger Sequencing |

| 8.3.2. Next-Generation Sequencing (NGS) |

| 8.3.3. Third-Generation Sequencing |

| 8.3.4. Targeted Sequencing |

| 8.4. Middle East & Africa Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Application, 2021-2032 |

| 8.4.1. Oncology |

| 8.4.2. Reproductive Health |

| 8.4.3. Clinical Investigation |

| 8.4.4. Agrigenomics & Forensics |

| 8.4.5. Metagenomics |

| 8.4.6. Epidemiology & Drug Development |

| 8.5. North America Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Sources, 2021-2032 |

| 8.5.1. Consumables |

| 8.5.2. Instruments |

| 8.5.3. Services |

| 8.6. Middle East & Africa Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By End-user, 2021-2032 |

| 8.6.1. Hospital & Clinnics |

| 8.6.2. Research Institutions |

| 8.6.3. Clinical Research Organizations (CROs) |

| 8.7. Middle East & Africa Diagnostics DNA Sequencing Market Analysis, Opportunity and Forecast, By Country, 2021-2032 |

| 8.7.1. GCC Countries |

| 8.7.2. South Africa |

| 8.7.3. Rest of Middle East & Africa |

| 9. Global Diagnostics DNA Sequencing Market Competitive Landscape, Market Share Analysis, and Company Profiles |

| 9.1. Diagnostics DNA Sequencing Market Share Analysis, By Company (2024) |

| 9.2. Company Profiles |

| 1. Illumina |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 2. Thermo Fischer Scientific |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 3. Agilent Technologies |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 4. QIAGEN |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 5. BGI Genomics |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 6. Pacific Biosciences (PacBio) |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 7. Oxford Nanopore Technologies |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 8. Bio-Rad Laboratories |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 9. Eurofins Genomics |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 10. Takara Bio |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 11. F. Hoffmann-La Roche Ltd |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 12. Beckman Coulter |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 13. Swift Biosciences |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 14. Genomatix Software GmbH |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 15. Ginkgo Bioworks |

| Company Overview |

| Financial Highlights |

| Product Portfolio |

| SWOT Analysis |

| Key Strategies and Developments |

| 9.3. Competitive Comparison Matrix |

| 10. Research Methodology |

| 11. Conclusion and Recommedations |